Investors, keep your emotions in check!

Geert Van Herck

Chief Strategist KEYPRIVATE

March 24, 2023

(updated May 22, 2023)

5 minutes to read

There has been more nervousness on the international stock markets in recent weeks. The collapse of Silicon Valley Bank set in motion an emotional roller coaster. Pessimistic headlines have dominated the financial media day after day. In this case, keeping a cool head and not panicking is the right thing to do.

Strong surge in investor pessimism

Of course it may be expected that all this doom and gloom in the newspaper headlines will lead to pessimism among investors. This is also reflected in the CNN Fear and Greed index. This measure of market sentiment is currently indicating fear, and will probably stay there for a while.

However, you should be aware that bouts of panic like this have always offered good opportunities to savvy investors, provided they can keep their emotions in check. We expect this correction on the stock markets to be a temporary glitch in an upward trend.

Graph 1 : CNN Fear and Greed index

Source: CNN

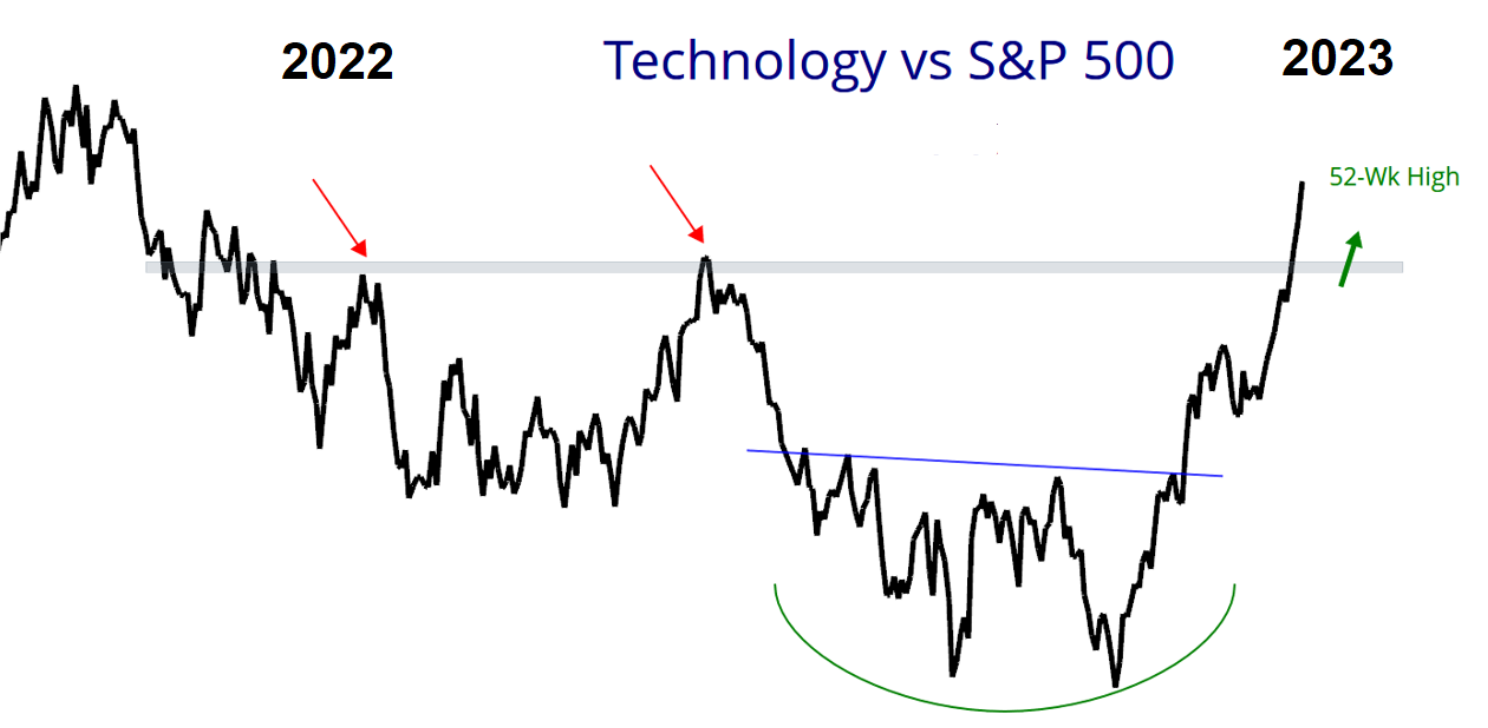

The relative strength of the US technology sector

Graph 2 shows that US technology stocks have outperformed the rest of the market for several months (based on the S&P 500 index).

In a crisis situation, it is quite unexpected to see investors fleeing to somewhat riskier technology stocks such as Netflix or Meta (ex-Facebook). Generally, defensive sectors such as food and drink and pharmaceuticals are more in line with expectations. Add to this the sharp rise in Bitcoin in recent weeks and we can conclude the market still has quite an appetite for risk. In our opinion, the current stock market correction therefore seems to be prompted by a sector rotation (from banks to technology and other fields) and not by a general flight from stocks.

Figure 2: Relative performance of the US technology industry

Source: All Star Charts

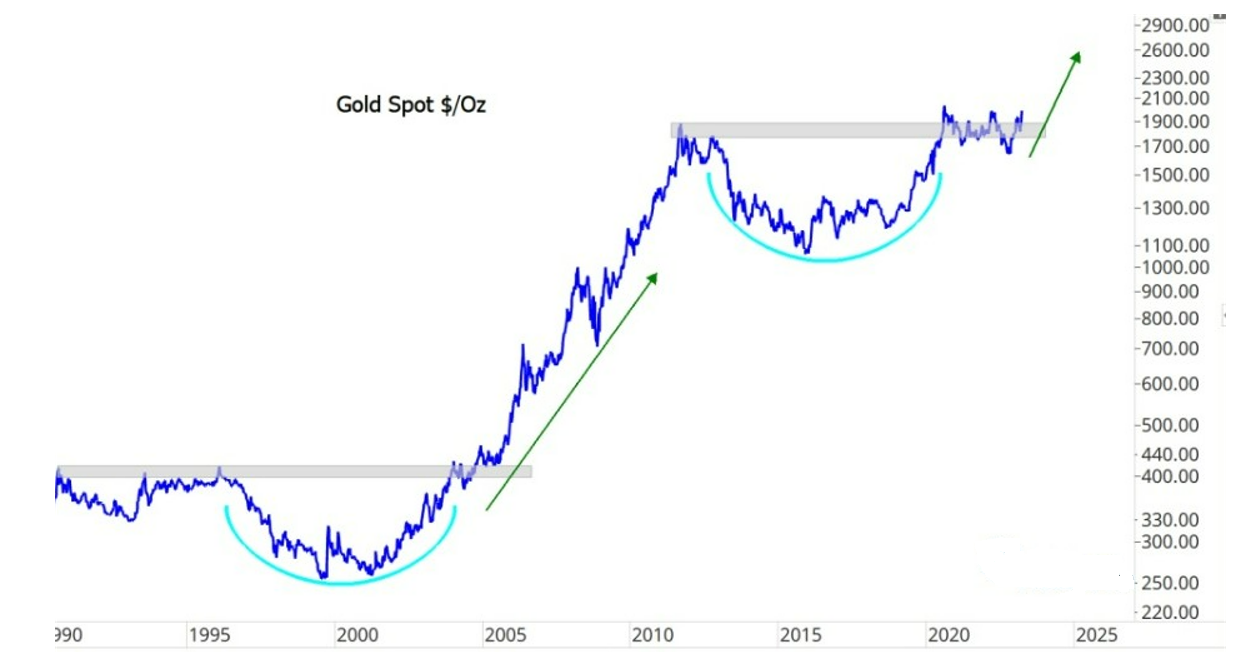

The panic has had a positive effect on gold prices. Gold is still a haven or hiding place for investors who temporarily want to reduce their equity exposure. Bear in mind, however, that if we take a look at the slightly longer term, we see that the rise in the gold price started in 2015 already and now appears to be resulting in new record prices. Anyone who finds the stock market too nervous at the moment may well see gold as a good home for their money.

Figure 3: Gold price trend

Source: Grindstone Intelligence

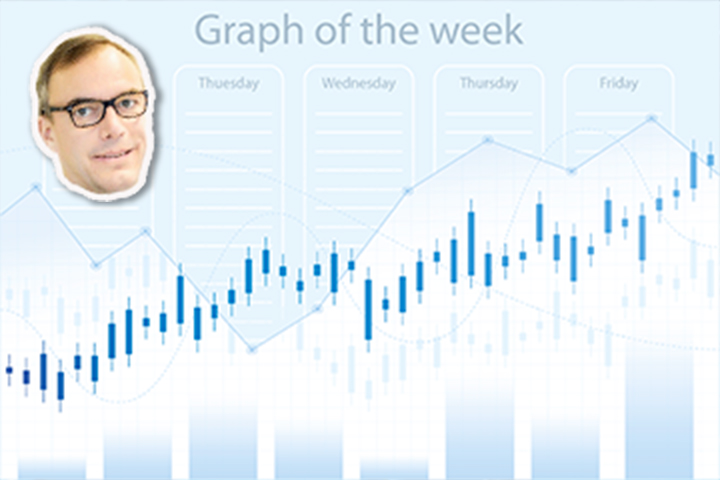

The S&P 500 continues to rise

And in our opinion, that is still the most important conclusion! Figure 4 shows that ever since October 2022, the S&P 500 – still the benchmark index for international investors – shows a pattern of higher lows. That is a crucial factor in our stock market trend analysis: as long as that pattern is not broken (in other words, as long as this index does not fall below the "higher lows" of December 2022 and March 2023), there is no reason to panic and sell stocks. In the current circumstances, we are therefore keeping a cool head without any rash actions in the Keyprivate portfolios.

Figure 4: S&P 500 trend

Source: All Star Charts

The collapse of Silicon Valley Bank caused a panic and equity investor jitters. It is therefore advisable to take a step back from this emotional roller coaster and look at the trend underlying the most important stock market indices.

We find that there is still a pattern of higher lows. As long as this pattern does not change, we as investors simply have to accept this correction. It is part of the game. In the meantime, gold seems to be an option for those wanting to take a break from the game.

Other articles that might interest you

Monthly video 2026

Panic may once again be a poor guide right now

The mini dictionary for novice investors

Investing funds without any risk may sound impossible, but…

What is a return, and how does it benefit you as an investor?

Valentine’s rally: romance meets precious metals

Stock market romance: profiting from Valentine’s Day?

Ten lessons that stand the test of time: The legacy of the Oracle of Omaha

Monthly video 2025

Are we in an AI bubble?

Are luxury stocks worth investing in?

Investing in AI: hype or a ticket to the future?

Will AI replace human investment advisers?

From stadia to the trading floor: here's how to invest in sport

Lost in the ETF jungle? Here's a compass to help you find your way

What is a tracker and how do you choose the right one?

Investing in stock market newcomers: a sensible strategy?

Graph of the week: Industry has not succumbed to Trump!

Why are shares continuing to rise? No-one knows

What should you do during the next stock market crash?

Belgium becomes a global player in healthcare real estate

Should we be concerned about the US debt mountain?

Have you considered investing in Latin America?

Risks and opportunities in the energy sector

New reductions in stamp duty for home buyers

After the gold rally, is it silver's turn?

Why the S&P 500 does and does not have a problem

Investing in future index constituents: opportunities and pitfalls

Does Japan have the most underestimated stock market in the world?

Is stagflation becoming the new buzzword?

Humanoid robots: hype or golden opportunity for investors?

US shares no longer number one!

Passive investing: less effort for a better return

Will there be a recession in the US?

As cruise companies gather steam, are their shares doing the same?

Is Elon Musk about to crash Tesla shares?

American optimism reversing: time to head for the exit?

Have the Magnificent 7 lost their magic?

An investment guide to Europe's military resurgence

Are European bank stocks experiencing a renaissance?

Dividend aristocrats: a good beginner investment strategy?

Has the obesity trade peaked?

Monthly video 2024

How to invest in AI after the DeepSeek bomb

What is investing, and why is it an option for you?

Investors missed out on many great opportunities in 2024

What you need to know before you start dividend investing

Which loan is the best fit for your renovation project?

Lump-sum investing vs cost averaging: which offers the highest return?

FIRE: how hot is this financial trend and how does it work?

What type of investor are you? Take the quiz

Did you just purchase shares? Why you should immediately set a stop-loss

Democrats or Republicans: which party is better for your investments?

8 years of Keyprivate: let's take stock

Actively managed ETFs: the best of both worlds?

Investing at new highs is an elevated idea

6 reasons to invest in food

Take a moment to read this before sharing your data

Untaxed side jobs: what is allowed and what is not (any more)?

Who's who at Keytrade Bank? Who answers the phone when you call us?

Who's Who? Visiting IT

Buying real estate together? Consider a rights of survivorship clause

Would it be better to buy a student room than rent one?

House flipping: is it worthwhile?

Investing in football shares: what's the score?

Is it time to invest in Chinese stocks again?

Europe is no longer falling behind!

The difference between distribution and accumulation for funds or trackers

Will ultra-low interest rates make a comeback? Probably not…

How to recognise investment fraud

Coronablog by Geert Van Herck: Market Observations

Are money market funds an attractive investment?

Is joining the BEL20 actually good for you?

Stock market records: some down-to-earth advice on how to respond to dazzling heights

Can we still say "Magnificent Seven"? Or should it be "2 Unlimited "?

Invest yourself or have someone do it for you: do you have to choose?

How do you protect your smartphone from hackers?

Monthly video 2023

Small company shares with big opportunities?

8 questions and answers about holding companies

Nigeria: a new hot spot for adventurous investors?

Exemption from withholding tax on dividends

Looking back on 2023

Will bonds beat shares in 2024?

Don't forget to create an extra access!

Shorting: what is it and how does it work?

The 10 principles of stock market success

How to invest in the energy transition?

Good positional play is important!

Keytrade Bank has one of the few free credit cards on the Belgian market

Is India the new China?

Padel has got a new doubles partner with Keytrade Bank

Keytrade Bank chose SOPIAD to integrate a ‘sustainable preferences module’ in Keyprivate

Investors are not afraid of risks! Or not yet?

Get ready for the last quarter!

Investing in biodiversity: can Wall Street save the rainforest?

Don't forget to make arrangements for your digital estate

Saving for the sake of saving? Or with a goal in mind?

How do you prepare financially for a longer life?

Handling recessions: a manual

How to navigate a relationship with lopsided incomes?

Avoiding and dealing with conflicts on financial matters: a guide

Money management in a new blended family: a step-by-step plan

1 account for the both of you? Or separate accounts? Or a combo?

Make an impact with your Keyprivate

It is impossible to disinherit your child in Belgium: fact or fiction?

Which investment opportunities are available on the road to smart mobility?

A vitamin shot for your investments

Does water earn a place in your portfolio?

What is the difference between a tracker and a fund?

Bonds to rise in 2023?

“The headwinds should ease up in the second half of 2023”

“More chaff will be separated from the wheat on the stock exchanges”

2022: 840 000EUR in bonuses and (a higher interest rate on your savings account)

Monthly video 2022

A Keytrade Bank Nature Trail? Yes, please.

Museum of Circular Economy: what’s next?

A recession and yet the markets are going up?!

Investors? Do you want to remain on the sidelines now?

Who's who at Keytrade Bank? Data first

Less costs? Yes, please.

Is tighter monetary policy acting as a brake on the stock market upturn?

How can you donate or leave a legacy to a charity?

As close as possible to staff

Belgian traders tempted by American stock market rush and Reddit investors

Getting nervous about the stock market? Take a look at the 200-day moving average

A Keytrade Bank Nature Trail? Yes, please.

How do you find out what a company’s ESG rating is?

ESG's alphabet

How can you make an investment portfolio inflation-resistant?

No extra costs ...

CARD STOP has a new number! 078 170 170

This is what the tax authorities know about your money

Investing in dividend shares: what to look for?

10 ways to save money with apps

Monthly video 2021

Five tips for keeping a cool head when the stock market becomes turbulent

How do I choose the right shares?

Could there be a little more of using a little less?

Which investment style and which regions would benefit from renewed growth in interest rates?

Which shares will be the rising stars once interest rates start increasing again?

Short selling: what is it and how does it work?

10 things you can do within a day to improve your financial health

Enjoy your stay at the hotel and pay less

Baby on the way? Make sure your finances are ready for it, too

How to protect your capital in the event of a divorce

The halo effect: why we are buying the shares of Buffett, Bezos and Musk

Why investing for your child is a good idea

La technologie préserve les investisseurs contre l'utopie

How to include your grandchildren in your inheritance planning: 8 questions and answers

Rising debt: is it a problem?

Funds and trackers: do you opt for capitalisation or distribution?

Rent or buy? How to use the price-to-rent ratio

Can I invest even if I do not have a large sum of money available?

CARD STOP has a new number! 078 170 170

The treacherous stock market

Stock market versus bricks and mortar: 1-0

Buying a second residence: with savings, investments or a loan?

Always have a megatrend in your portfolio

Maths on the stock market

Are you investing really globally with a tracker on a world index?

7 investment themes for 2029 (for which you can get a head start already)

Ten basic rules for lifelong success on the stock market

Share everything with peace of mind. Except your bank cards.

Any dip in the global economy appears to just a passing blip!

Coronablog de Geert Van Herck: La panique atteint des sommets… énième épisode

Seven investment myths

Tips from an expert: how to keep your passwords safe

Coronavirus blog by Geert Van Herck: S&P 500 indicates a positive trend

What retirement pension will you get later?

How can we cope with financial stress?

Gift or inheritance: which is the most tax-efficient?

Making an offer on a property: what should you look out for?

Saving your payment card details in your browser: yay or nay?

No extra costs. Yet 700,000 euros gladly given to you, our customers!

Are trackers the latest bubble on the financial markets?

Going for gold? Gold is apparently going for it.

Are you a contrarian investor?