Any dip in the global economy appears to just a passing blip!

Geert Van Herck

Chief Strategist KEYPRIVATE

December 21, 2021

(updated January 26, 2022)

4 minutes to read

Global economic growth slowed last month, although in our opinion this is not the precursor to a recession. We believe it is mainly due to a shortage of labour and of certain components for the production of goods and services.

As a result, some companies and sectors are being forced to cut back their production temporarily. This, of course, has a temporary impact on economic growth. We think it is temporary, because we are already seeing signs in the Asian producer countries that production is on the rise again. What is the outlook for the global economy?

In order to closely monitor developments in international economic activity, Keytrade Bank looks each month at the report of international producer confidence. This report from the research firm IHS Markit in collaboration with JPMorgan is based on a global survey of more than 10,000 business leaders.

This makes it an excellent barometer of the state of health of the global economy. All you need to remember is that ratings above 50 points indicate an expansion of economic activity at a global level, while ratings below 50 points indicate a contraction.

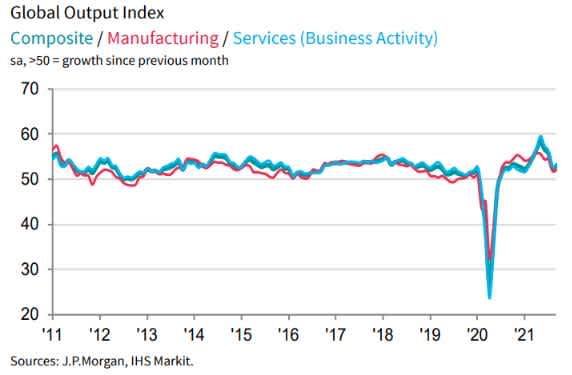

GDiagram 1 shows the trend in international producer confidence, for overall producer confidence ("Composite") and separately for the industrial sector ("Manufacturing") and the service sector ("Services"). Apart from the very sharp recovery since mid-2020, we have seen a decline in recent months, due to the consequences of last year’s coronavirus crisis. In the Asian producer countries in particular, the vaccination rate is not as high as in the West, resulting in fewer workers in the factories. In addition, there is a very sharp increase in Western demand for consumer goods, such as computers and cars. The combination of these two things means that some components from these countries cannot reach Western factories quickly enough.

This in turn leads to a temporary period of lower production and economic growth. A good example is the German vehicle sector. At present, it does not have enough electronic components such as semiconductors or chips, which means that the car factories are temporarily running at a slower rate.

Diagram 1: Trend in global producer confidence

Source: IHS Markit, JPMorgan

Improvement is lurking just round the corner. On the right-hand side of the graph, we can see that the decline in international producer confidence appears to have stopped. Are we seeing a potential revival there?

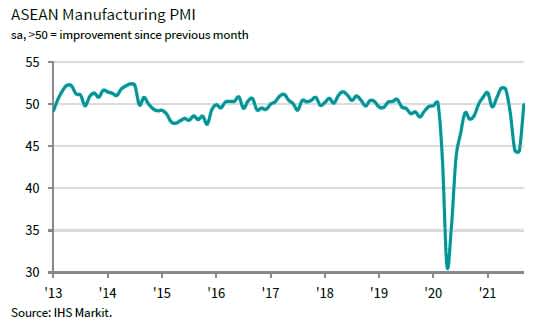

Another important reason why we dare to believe in this turnaround comes from Southeast Asia. And more specifically from the ASEAN countries (Indonesia, Malaysia, Myanmar, Philippines, Singapore, Thailand and Vietnam). Together with China, these countries are also known as the “world’s factory”. Many, many Western companies have production centres here that export to the West.

This makes the trends in these countries a good barometer for the global economy, as you can see in Diagram 2. After a few months of contraction, producer confidence in the ASEAN countries has gone back up to 50 points.

We are therefore expecting to see figures above 50 points recorded in the next few months. Especially now that progress is being made with coronavirus vaccination, which in turn means more workers being available for the production process.

Diagram 2: Trend in producer confidence in the ASEAN countries

Source: IHS Markit

Conclusion

The global economy has cooled somewhat in recent months, with the shortage of components for Western factories being one of the most significant explanations. Now that the world’s factory seems likely to restart full economic activity, we are optimistic about the near economic future. We look forward to the global economy continuing to expand rather than fearing a recession.

Geert Van Herck Chief Strategist KEYPRIVATE