Funds and trackers: do you opt for capitalisation or distribution?

Keytrade Bank

keytradebank.be

September 08, 2021

(updated July 06, 2022)

5 minutes to read

Once you have chosen a fund or tracker you wish to invest in, you usually need to make another choice. Most funds and trackers have a distribution option and a capitalisation option. If you choose the capitalisation option, the manager will reinvest all the income from the dividends and coupons. If you go for the distribution option, the manager will pay out the income to you periodically as dividends.

Before you choose one or the other, it is a good idea to consider the advantages and disadvantages. The wrong choice can reduce your yield considerably.

Why go for a distribution option?

Investing often means waiting 5, 10 or 20 years to achieve the intended goal. This requires a great deal of patience and endurance. Dividends are attractive because they ease the pain of waiting for a return. Even through you need many years of discipline to invest successfully in the long term, a dividend eases the pain every now and then.

Dividends (and therefore distribution funds and trackers) are also an interesting way of providing a regular or additional income. You can compare it to renting out a property. While the property's value increases over the years, in the meantime, you already receive rental income. A distribution option can therefore be useful if you are retired with a fairly low statutory pension. The dividends paid out will then offer extra income.

A distribution option can also be an interesting choice as part of your asset planning. If, for example, you wish to give part of your investments to your children, you can do this subject to usufruct. This means that even though your children become the owners of the investments, the income from them will still go to you.

Why choose a capitalisation option?

A capitalisation option gives you a compound return: in other words, a return on the return. In the capitalisation option, the income from dividends and/or coupons is reinvested. This reinvested income can then yield its own return. In this way, you create a snowball effect.

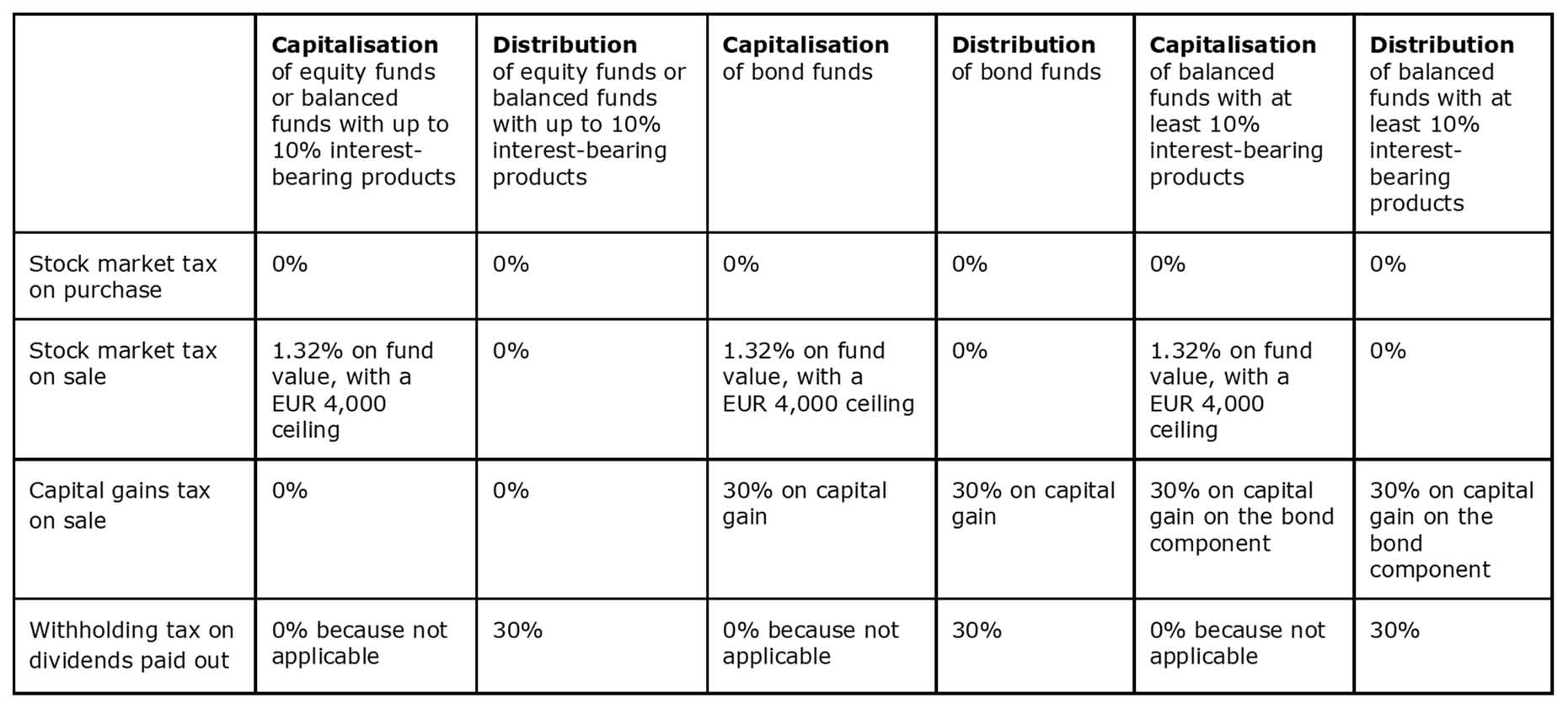

Although the distribution option also seems attractive, it has one major disadvantage compared to the capitalisation option: taxation. In the case of a capitalisation option, you pay 1.32% in stock exchange tax on the sale of conventional unlisted funds (not on the purchase) with a EUR 4,000 ceiling for each sale. In case of a distribution option, no stock market tax is due on purchases or sales, but you pay 30% in withholding tax on the dividends (no ceiling).

An example will show the impact this can have: an equity fund with a 3% dividend yield results in a net return of 2.1% once the 30% withholding tax has been deducted. This means that 0.9% of the fund's value goes to withholding tax each year. If you keep the fund for three years, you will have paid a total of 2.7% (3 x 0.9%) in withholding tax (moreover, this withholding tax cannot be recovered). However, if you go for the capitalisation option, you will only pay 1.32% of the investment's value in stock market tax, far less than the 2.7% from the above example.

In the long term, it is therefore much more interesting to choose the capitalisation option for equity funds. Note: in certain cases, a 30% withholding tax does apply to the capital gains made when a fund is sold. This happens when the fund invests at least 10% in interest-bearing products (bonds, treasury bills and so on).

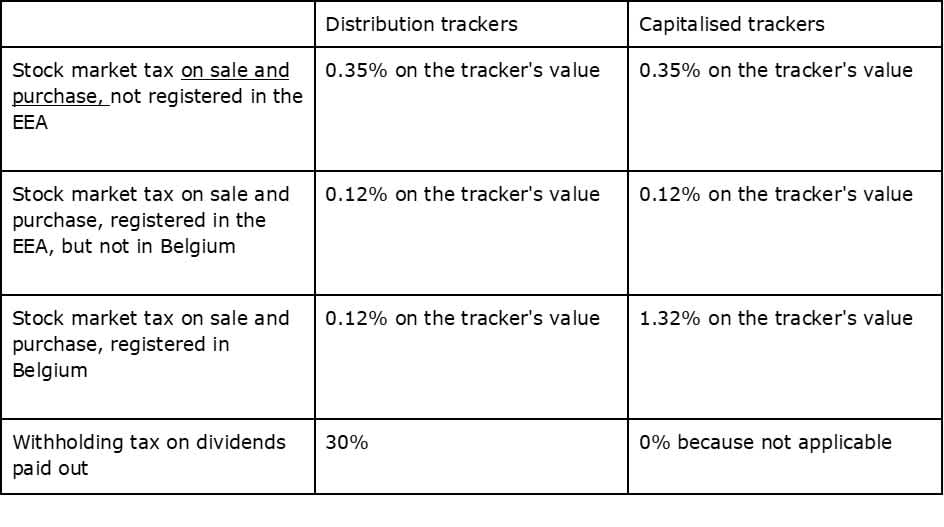

The situation is different again for trackers (ETFs or listed index funds). The applicable tax rate depends on whether your tracker pays out or reinvests its dividends, what type of tracker it is and where the tracker was registered. You usually pay 0.12% stock market tax both on purchase and sale for both the capitalisation and distribution options (see overview of all possibilities). In the event of distribution, you pay 30% withholding tax as you would do for conventional, unlisted funds.

There is a second reason why a capitalisation option can be more interesting for both funds and trackers. If you invest in a fund or tracker, you do not invest directly in the underlying shares or bonds. As a rule, the manager of the fund or tracker will also pay a tax at source (i.e. withholding tax) on the shares and/or bonds in the portfolio.

However, it is highly likely that you will also have to pay withholding tax on the dividend you receive. This means you may be taxed twice. However, the manager of the fund or tracker can fill out certain certificates to benefit from a double taxation treaty that will reduce the tax at source. Not all managers do this, though.

By and large, we can say that if you do not need the dividends and/or in case of a long-term investment, a capitalisation option may be best for you.