Get ready for the last quarter!

Geert Van Herck

Chief Strategist KEYPRIVATE

September 12, 2023

(updated September 27, 2023)

4 minutes to read

It has been a volatile few weeks for the stock markets. The rise in US long-term interest rates has led to price pressures on the most important shares in the technology sector.

Their heavy weighting in technology stocks caused the S&P 500 and the Nasdaq to fall by more than 5%. This correction took some investors completely by surprise. But why was this the case? An analysis of seasonal effects shows that August and September are not the best months for the stock markets.

After a fantastic July, the major stock markets fell in August of this year. Stock market commentators blamed this on higher long-term interest rates. Higher interest rates were putting a damper on economic growth. Of course, this is not good news for corporate earnings.

The first victims of this correction were technology stocks, which lost more than 7% in the first weeks of the August correction. Following a good performance in July, August was a painful wake-up call for some investors. Nevertheless, this stock market weakness should not be a surprise: we know from historical research that August and September are traditionally months with an overall negative stock market performance.

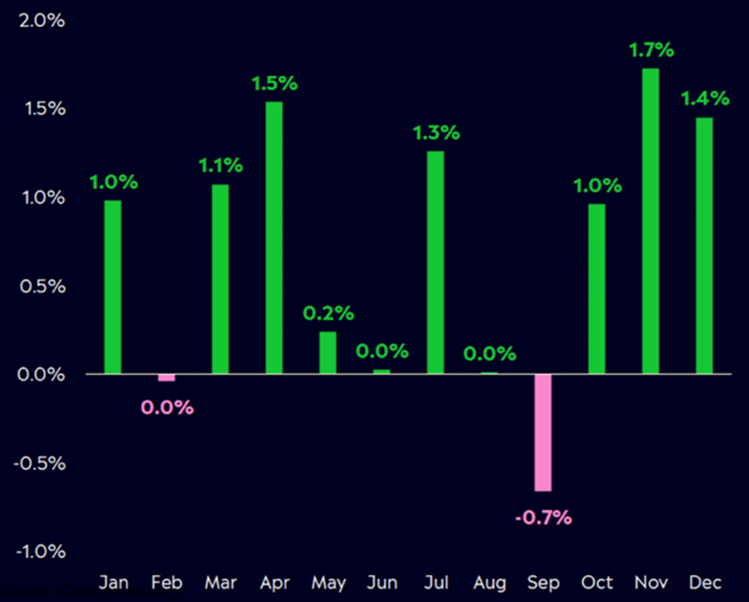

Table 1 shows the average monthly performance of the S&P 500. The current period (August – September) has been the weakest of the year since the 1950s. September is a particularly negative month with an average loss of -0.7%. However, the last three months of the year frequently offer good returns. We therefore urge investors not to panic, but rather to look out for quality shares whose prices have fallen as a result of the correction in August and September.

Graph 1: average monthly S&P 500 return

Source: Bloomberg

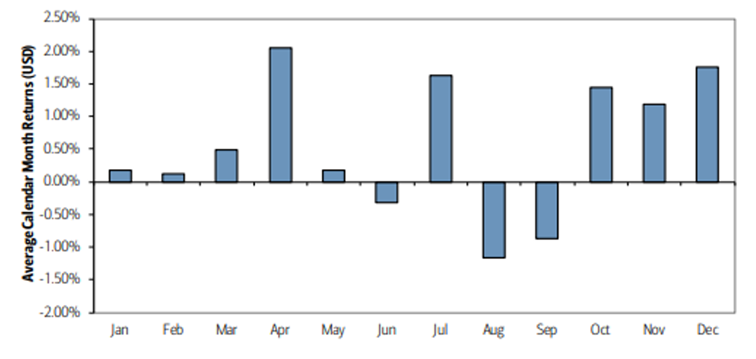

This is not just an American phenomenon. This seasonal effect is also clearly visible in Table 2 for the global benchmark index, the MSCI All Countries World Index. In addition to the most important Western equities, the MSCI All Countries World Index includes equities from emerging countries such as China, Brazil and India. August and September are also the two negative outliers here. Once again, the upcoming fourth quarter represents an opportunity for those investors who see the current price fall as an opportunity to increase their equity positions.

Graph 2: average monthly return on the MSCI All Countries World Index

Source: BofA Global Research

Conclusion

Some investors became cautious recently when the stock markets went into correction mode. For some analysts, the reason for this correction was the rise in long-term interest rates.

However, our analysis points more towards "traditional" seasonal effects. August and September are traditionally the weakest months of the year. This year's stock-market fluctuations have confirmed this once again. Even so, an alert investor should not be worried: now is the time to take advantage of the lower prices to build up equity positions and enjoy a strong stock-market performance in the fourth quarter.