Is stagflation becoming the new buzzword?

Geert Van Herck

Chief Strategist KEYPRIVATE

May 21, 2025

2 minutes to read

Is Donald Trump pushing the global economy into recession? We see this question being raised more and more often. The new American president's recent decisions are certainly having a negative impact on economic productivity. International business leaders' confidence in the near future has taken a serious hit. As a result, business leaders with less confidence will naturally be reluctant to invest.

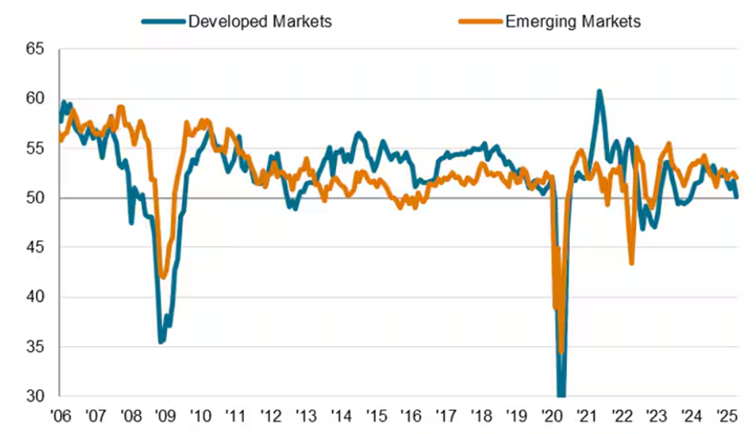

Graph 1 shows the trend in manufacturing and services output for Western developed countries and emerging markets such as China, India and Brazil. The 50-point level is crucial here. Above 50 points, we are looking at expanding economic activity. Below 50 indicates contraction. It is clear that Western developed countries are flirting with the 50-point level.

Even more important is the trend shown in this graph. It has been on a clearly downward trend in recent months. This direction equates to a downturn in growth for the global economy.

Source: S&P Global

Besides slowing economic growth, there is a second important trend in the global economy: the trend of rising prices. There, too, we can't help but scrutinise the new US administration's recent decisions. For example, they increased import tariffs on steel and aluminium by 25%. They are found in many everyday consumer goods and are therefore very important cyclical commodities.

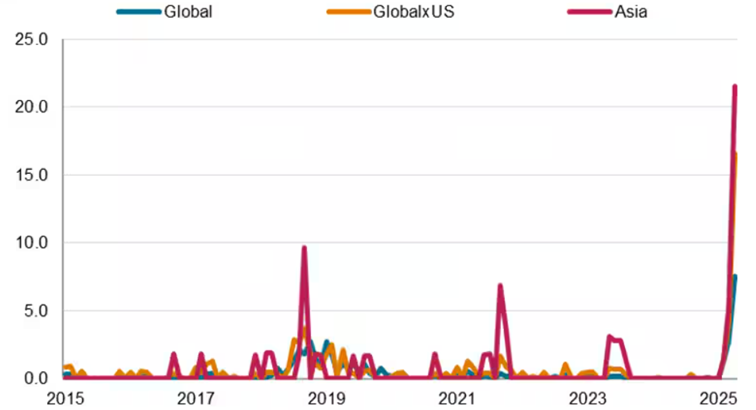

Graph 2 shows the number of companies worldwide claiming that higher tariffs will lead to higher sales prices. In our opinion, this graph leaves little to the imagination. In all economic regions, we are seeing an explosion of companies pointing to the tariff war as the main reason for their price increases. It also shows that companies are passing these higher tariffs on to their customers, which could lead to a spiral of higher prices. Who knows: this may encourage Western central banks to stop lowering their short-term interest rates.

Source: S&P Global

Will we be dragged into a stagflation scenario in the coming weeks and months? That is the question. The ‘stag’ in this word stands for stagnant economic growth (the message conveyed by graph 1), while ‘flation’ refers to inflation (the message conveyed by graph 2). In any case, stagflation is a particularly difficult environment for economic policymakers and central banks.

This makes it difficult to lower short-term interest rates quickly and decisively as a means of giving the economy some breathing room. This is because lower interest rates will fuel economic growth, but also push up inflation, which is already at a high level…

Let us hope, then, that international trade tensions ease significantly and the threat of inflation subsides as a result.

Conclusion

Recent macroeconomic statistics show that a stagflation scenario cannot be ruled out. Such a scenario gives central banks little room for manoeuvre to use interest rates to stimulate growth. Investors are therefore well advised to opt for strong, quality companies with solid margins and low debt or to invest in funds/trackers that focus on these types of businesses.