Coronavirus blog by Geert Van Herck: S&P 500 indicates a positive trend

Geert Van Herck

Chief Strategist KEYPRIVATE

June 08, 2020

(updated January 24, 2022)

3 minutes to read

The US stock exchange has done well to absorb the blow delivered by the coronavirus, showing how remarkably resistant it is. One key reason for this is the strong influence of the technology sector. Companies like Amazon and Netflix benefited from the crisis thanks to their online shopping and streaming business models. They could offer exactly what people were looking for during lockdown.

The recovery of the S&P 500 also provided us with a number of positive technical signals. Regular readers of this blog know that when planning our investment strategy, we attach a great deal of importance to trend analysis. Specifically, we check at regular intervals whether a stock exchange index has moved above its 12-month moving average line.

If the index is above the 12-month moving average, this indicates a rising trend. When it remains below the average, this points to a falling trend. When investors know this, they can adjust their portfolios accordingly. If a signal indicates a falling trend, we should take a more defensive approach until we see signs of a rising trend once more.

At the end of May, the S&P 500 provided a key "positive" trend signal. At the end of February the index was urging us to sell, but by the end of May we saw a call to buy once again on Wall Street.

Graph 1 : S&P 500 monthly chart (USD)

Source: Bloomberg

Is this optimistic attitude on the US exchange evident elsewhere in the world?

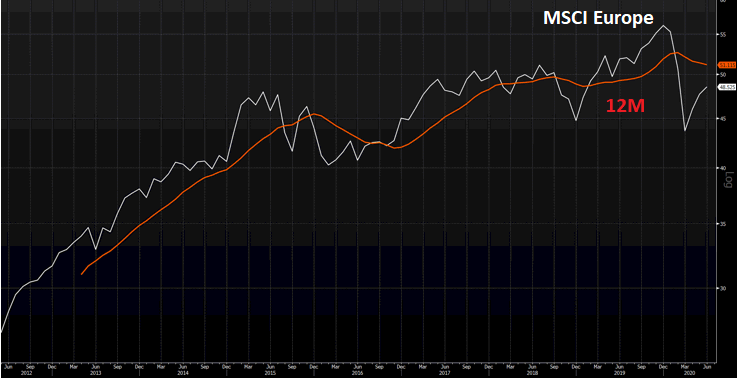

Things are sensitive right now. It seems the other major economic regions are following a different tack. For example, we can see that neither the indices of emerging countries (incl. China, Brazil, India) nor those of the European stock exchanges are issuing any new buy signals. Image 2 shows us the MSCI Europe, which at the end of May was still a little below the 12-month moving average.

This is why we are remaining extremely cautious this month. We need to see confirmation of this on the European stock market index, before we start talking about a global stock market recovery. For now, all we have is a positive signal from the US stock market.

Graph 2 : MSCI Europe (EUR) monthly chart

Source: Bloomberg

What can we conclude?

Even though a trend analysis from the leading S&P 500 has already brought us good news (with signs of a rising trend), we have not yet found confirmation of this anywhere else in the world. For the next few weeks, then, let's keep a sharp eye on the European stock exchanges and the markets in emerging countries. Perhaps they, too, will be giving us positive trend signals before long.