Stock market versus bricks and mortar: 1-0

Keytrade Bank

keytradebank.be

December 03, 2019

(updated February 09, 2022)

4 minutes to read

Those who have been househunting in recent years have undoubtedly been hit where it hurts – in their pockets. Whether it's a small studio or a grand villa, real estate prices are constantly on the rise. The historically low interest rates on mortgages are one explanation: with buyers able to borrow more, those selling simply put their asking prices up.

Yet it's not all down to the low interest rates, as demand for real estate has gone up due to the rising number of residents and the increasing number of smaller families. The result is that more, and smaller families are looking for a home. In addition, an increasing number of Belgians are buying real estate to diversify their assets and/or generate extra income.

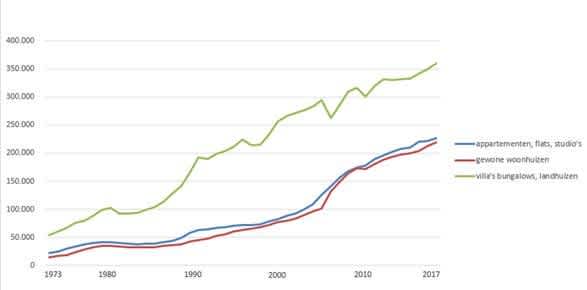

If we look at the prices of real estate over roughly the last fifty years, the figures speak for themselves. Despite a few dips, the graphs show significant upward trends.

Sale of real estate in Belgium according to the type of cadastral plan – average price in real terms (1973-2017)

Source: Statbel

Belgian shares versus Belgian real estate: 1-0

Belgian real estate? At first glance, you'd think that's a win-win situation. But what if we compared Belgian real estate with Belgian shares? De Tijd went through the archives in 2018 to do just that. The daily business newspaper calculated the average return on all Belgian shares listed on the Brussels stock market from the start of 1968 to the end of 2017. Dividends paid out were included, with the assumption that the dividends were immediately invested in the underlying share. Inflation was also considered in the calculation to arrive at the real return. The result? If you invested €1,000 on the Brussels stock market at the start of 1968, you'd bagged a return of €22,800 (after inflation). That equates to a return of 6.5% on an annual basis – and takes the stock market crashes of 1974 and 2008 into account, too.

Those who decided to invest in real estate fared less well: the €1,000 you invested in bricks and mortar in 1968 was worth €2,500 at the end of 2017 (after inflation), a return of 1.8% on an annual basis. Of course, this comparison should be taken with a pinch of salt as on the one hand, it doesn't take into account any returns resulting from rental income, while on the other it doesn't consider maintenance investments and any periods during which the real estate may have been empty. Yet the difference is clear.

€1,000 invested in Belgian shares in 1968 = €22,800 at the end of 2017 (after inflation)

€1,000 invested in Belgian real estate in 1968 = €2,500 at the end of 2017 (after inflation)

Source: De Tijd

International shares versus Belgian real estate: 1-0

At Credit Suisse, they delved even further into the archives. Data from 23 representative countries shows that between 1900 and 2017, shares generated an average annual return of 5.2% (after inflation). And if we look at the last 50 years, the return stands at 5.3% per year. In the same period, European and American shares generated an annual return of 6.3% and 5.7% respectively.

Annual return 1968-2017 (after inflation)

- Belgian real estate: 1.8%

- Belgian shares: 6.5%

- European shares: 6.3%

- American shares: 5.7%

- Global shares: 5.3%

Source: De Tijd and Credit Suisse

The conclusion that can be drawn here is that if you compare shares with Belgian real estate, shares historically generate a significantly higher return. That said, you should also take other factors into account when making a comparison, such as the time, energy and money you put into your investments or bricks and mortar.

Sources: Statbel, Credit Suisse Global Investment Returns Yearbook 2018, De Tijd

Other articles that might interest you

Monthly video 2026

Panic may once again be a poor guide right now

Why a child deserves pocket money

14 surprising savings ideas

Guide: how much you need in savings

How much money do you have – without knowing it?

A hassle-free guide to switching banks

Why you should keep your account statements

ChatGPT as financial adviser: reliable or not?

What is interest and what does it have to do with your savings account?

Investing in the $1,000 club

Why you should pay in the maximum amount to your pension savings in January

Planning to live together or get married? What this means if your partner is in debt...

Monthly video 2025

From siestas to sprints, the Spanish stock market surprises investors

Is it time to say goodbye to bonds?

Do you have a dormant account? This is how you can check!

Will AI replace human investment advisers?

How can I invest or save better for my child?

Gifting money: register or take the risk?

Think twice before entrusting your will to ChatGPT

Buying or renting after you turn 50: which option is best for your future plans?

Why you can take out a home loan too as a single person

How high students’ earnings may, and more importantly, may not be

Is a buy-to-let property a smart investment?

How much can you borrow for a home?

Borrowing for a second home: what are your options?

Property shares: ripe for a comeback?

Helping your (grand)children to buy a home: what are the options?

What if you are unable to pay the inheritance tax?

10 tips for the novice property investor

Planning renovations? Which renovation grants are you (still) entitled to?

Investing in your partner’s home? Don’t make these mistakes!

Ever heard of the Zweig Breadth Thrust?

No children yet, but planning to have some? Here's how you can settle your inheritance

Humanoid robots: hype or golden opportunity for investors?

Defensive shares as a buffer?

A beginner's guide to buying shares in five steps

Your family member dies: how to manage their banking

Lending money to family or friends: do you have carte blanche?

What costs are involved in buying a home?

Are European bank stocks experiencing a renaissance?

Monthly video 2024

Investing when money is tight: being ambitious pays off!

12 questions and answers about a lasting power of attorney

40 years of pension savings: what will you spend it on (literally)?

From FOMO to ZERO bank account? 5x pension savings to the rescue

Start growing your pension sooner rather than later

Pension savings returns: these choices give the maximum payout

What monthly pension savings for a maximum return?

Why pension planning is even more important for women

United States 1, Everyone Else 0

What would the retired version of you say to yourself?

Did you just purchase shares? Why you should immediately set a stop-loss

A potential worldwide trade war is claiming European victims

Ever thought of investing in the pet industry?

Have long-term interest rates once again started a 40-year uptrend?

Graph of the Week: Magnificent 7 vs 2000s Tech Bubble

Checklist: travel without any money worries

Take a moment to read this before sharing your data

Buying real estate together? Consider a rights of survivorship clause

Investing in dividend shares: what to look for?

What your friends forgot to tell you about cheaper travel

Basic interest rate and loyalty bonus: what does your savings behaviour say about you?

Why high dividend yields can be a poisoned chalice

Comparing savings accounts: where do you put your money?

3 ways to invest when you don't have much time.

How do you select an investment fund for your child?

Secure online banking: how can you protect your finances?

Opening an online bank account: what is holding you back?

Robotics: From science fiction to science

Coronablog by Geert Van Herck: Market Observations

Is it the right time to invest in bonds?

Have you ever thought about investing for your children?

How can you invest in space travel?

Invest yourself or have someone do it for you: do you have to choose?

What do you have to tell the tax man about your money and investments?

Monthly video 2023

Five myths about sustainable investing

How can you invest in an ageing population?

6 reasons why installing solar panels is still worthwhile in 2024

How do elections affect the stock market?

Golden days? Why to invest in gold (or not)

Investing in emerging markets: are investment funds a smarter buy than trackers?

Don't forget to create an extra access!

The advantages and disadvantages of contactless payment

How to invest in the energy transition?

Keytrade Bank has one of the few free credit cards on the Belgian market

How to put phishers out of a job

Is India the new China?

Which sectors should remain overweight following the latest rate hike?

8 timeless rules for investors

Investors are not afraid of risks! Or not yet?

Saving for the sake of saving? Or with a goal in mind?

How do you prepare financially for a longer life?

How to navigate a relationship with lopsided incomes?

Avoiding and dealing with conflicts on financial matters: a guide

Investors, keep your emotions in check!

How natural disasters affect the economy and the markets

1 account for the both of you? Or separate accounts? Or a combo?

Make an impact with your Keyprivate

How much diversification is enough for your portfolio?

Which investment opportunities are available on the road to smart mobility?

A vitamin shot for your investments

Does water earn a place in your portfolio?

Bonds to rise in 2023?

6 things you need to know about your Keytrade Bank credit card

Monthly video 2022

A recession and yet the markets are going up?!

How to buy real estate with your supplementary pension (even though you have not retired yet)

Is tighter monetary policy acting as a brake on the stock market upturn?

Getting nervous about the stock market? Take a look at the 200-day moving average

With or without the coronavirus: why green investing remains just as relevant as before

Impact investing: sustainable investments with that little bit more

Sustainable investing: what, why and how?

How can you make an investment portfolio inflation-resistant?

No extra costs ...

CARD STOP has a new number! 078 170 170

10 ways to save money with apps

Monthly video 2021

Five tips for keeping a cool head when the stock market becomes turbulent

How do I choose the right shares?

No group insurance plan? What are the alternatives?

Short selling: what is it and how does it work?

10 things you can do within a day to improve your financial health

Enjoy your stay at the hotel and pay less

Cohousing rules

Timing is everything: how to choose the right time to enter the stock exchange?

La technologie préserve les investisseurs contre l'utopie

How to protect your hard-earned money from hackers

Why (not) invest in micro-caps?

Rising debt: is it a problem?

How safe are contactless payments?

Funds and trackers: do you opt for capitalisation or distribution?

Can I invest even if I do not have a large sum of money available?

What do I do to balance my investments?

CARD STOP has a new number! 078 170 170

On the way to a society without cash?

Buying a second residence: with savings, investments or a loan?

A must read for when you spotted a second-hand bargain online

Always have a megatrend in your portfolio

The handiest financial apps (and free as well)

Share everything with peace of mind. Except your bank cards.

Are we heading into a year-end rally by the stock markets?

Coronablog de Geert Van Herck: La panique atteint des sommets… énième épisode

Blended family: shared savings account or keep things separate?

First Aid for Your (Financial) Administration

Tips from an expert: how to keep your passwords safe

Coronavirus blog by Geert Van Herck: S&P 500 indicates a positive trend

What retirement pension will you get later?

How can we cope with financial stress?

Saving your payment card details in your browser: yay or nay?

No extra costs. Yet 700,000 euros gladly given to you, our customers!

US stock market dominance not coming to an end yet!

Going for gold? Gold is apparently going for it.

Are you a contrarian investor?