Are you investing really globally with a tracker on a world index?

Keytrade Bank

keytradebank.be

March 04, 2020

(updated February 09, 2022)

4 minutes to read

Nowadays, investing in trackers is more popular than ever, not least due to their attractive price. One of the most bought is the tracker that follows MSCI World Index. In recent years, it has been seen as a great investment. But is that still the case in the absence of any form of diversification? What's more, you know that past performances are no guarantee for the future.

Listen to a number of leading Belgian investment specialists, and you'll often hear a call to invest in ETFs. Warren Buffett, for example, advised his heirs to plough the largest part of his assets into an S&P 500 tracker. Why is this?

There are various advantages associated with tracker investments, with price being top of the list. It is true that they are much cheaper than traditional investment funds. , which is why people are often advised to invest part of their savings in a worldwide equities tracker. And why not invest in the MSCI World Index?

Investors who have decided to do so certainly aren't complaining, as the MSCI World Index (in euros) has achieved a good average annual return of around 10% in recent years. This can partly be explained by the high exposure to the American stock market, and partly by the gains made by the dollar against the euro. Even so, investors would be wise not to extrapolate this data and forecast a similar performance in the future.

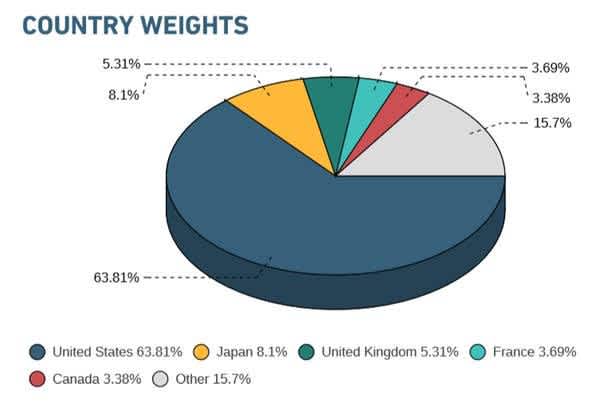

Allow us to explain. When you invest in a tracker following the MSCI World Index, you invest indirectly in the American stock market. Graph 1 shows that the US makes up around 64% of the index. In other words, investors in MSCI World Index link their fate to the performance of American equities. When you then see that an economic powerhouse such as Germany is not yet among the top five most important countries, diversification in this tracker is at a very low level.

Graph 1: Geographical distribution of the MSCI World Index

Source: MSCI

But why do we champion diversification?

Well, on the one hand, the American stock market is regarded as expensive according to traditional criteria (such as the price/earnings ratio). This, in turn, means lower expected returns for US equities. However, a changing of the guard seems to be around the corner – the European stock markets and the emerging markets in particular (such as China and Russia) have disappointed in the last decade compared to the American stock market. It would therefore be probable that the rest of the world could perform somewhat better in the next ten years. If you invest in MSCI World Index, you will not receive optimal returns.

"Don't put all your eggs in the American stock market's basket."

Build a global portfolio containing the US, Europe and emerging markets. You'll be sure to find a suitable tracker for all of these equity markets. By diversifying in this way, you'll also ensure lower risk. Being forewarned is forearmed when it comes to investing!