Investors? Do you want to remain on the sidelines now?

Geert Van Herck

Chief Strategist KEYPRIVATE

October 20, 2022

(updated November 17, 2022)

5 minutes to read

War in Ukraine, sky-high inflation figures in Western industrialised countries and an imminent recession in Europe. It should be no surprise that the stock markets have already gone heavily into the red this year. The fear is tangible.

But as always, panic is a poor adviser. Bear markets are often a good time to enter the market for those who want to put their savings to work. Over the past few weeks, we have noticed two interesting analyses. They confirm that throughout history a stock market correction has always been a good time to invest.

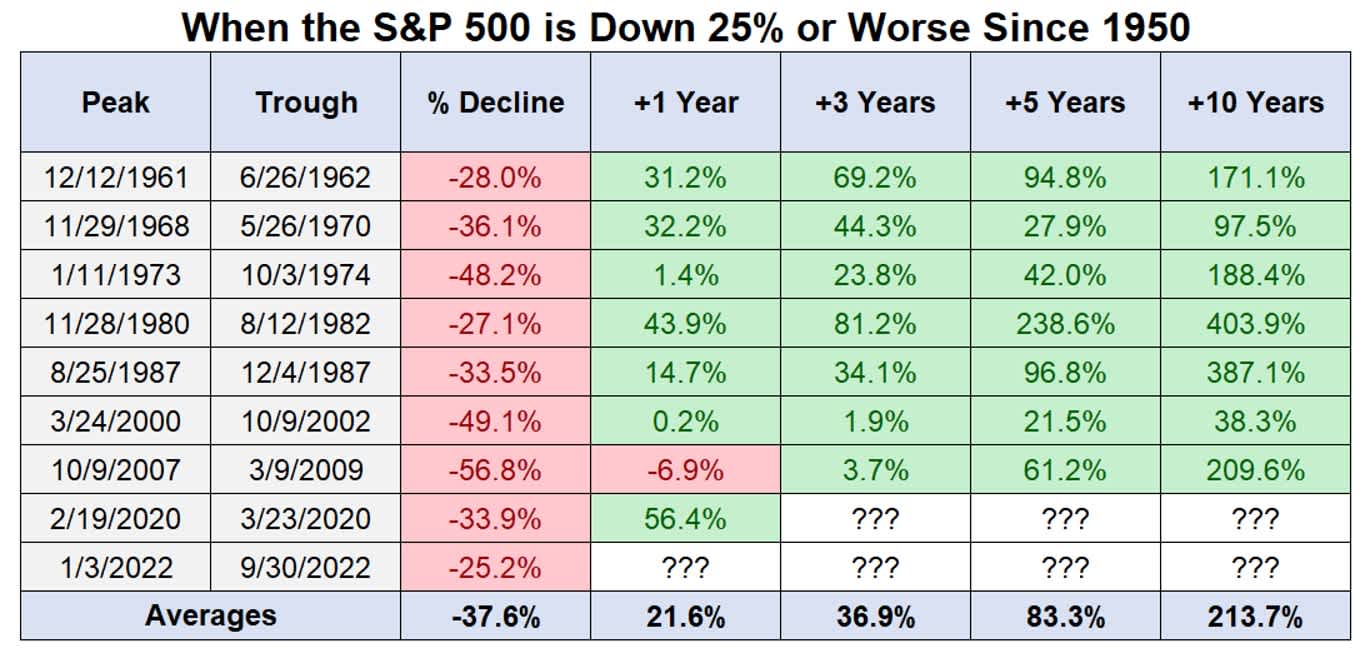

Table 1 shows the main bear markets since the 1950s. A bear market is any fall of more than 20% in the more important stock market indices. Most stock market indices in both the US and Europe have now passed this critical threshold.

The table shows the S&P 500, which is the benchmark index for the US equity market. This index also serves as a guide for the rest of the world. Since the 1950s, there have been nine periods (including the correction of 2022) when the S&P 500 lost 25% or more. Many investors will vividly remember the dotcom crisis of 2000 and the financial crisis of 2008. The most recent was the coronavirus crash in 2020.

During these slides on the stock markets, panic breaks out among investors and hardly anyone has the courage to enter the stock market. Investors are often heard to say that they are waiting for a correction before investing. However, if this correction does occur, nobody turns up. What we see is the vast majority remaining on the sidelines.

However, it is clear that those who have the courage to come on board at such a time will not be sorry. Because anyone who starts to buy after a 25% fall will be able to look back on a handsome return 1, 3 or 5 years later.

On average, there will be a positive return of 21% after 1 year, then after 3 years the profit will increase to 36% and 5 years later the portfolio will already have increased by an average of 83%!

Table 1: S&P 500 returns after a fall of 25% or more

Source: Ben Carlson

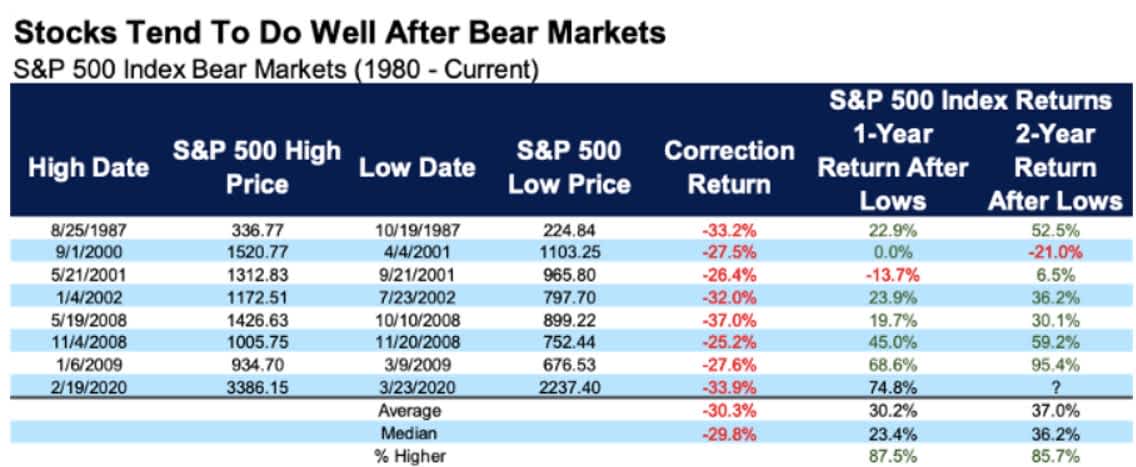

We also would like to inform readers that the returns from Table 1 were calculated by buying in on the first trading day after the month during which the S&P 500 fell by 25%. Table 2 shows each of the bear markets from 1980 to 2020. This covers all periods in which the S&P 500 fell by over 20%.

Again, we draw your attention to the last two columns of this table. When we look 1 and 2 years later at a market entry following a bear market, we see statistics that favour the "brave" investor. On average, the S&P 500 was some 30% (or more) higher after 1 and 2 years. What is perhaps even more important is the likelihood of a positive return. Overall, there is a more than 85% chance of higher prices following a bear market in the United States!

Table 2: S&P 500 returns after a bear market

Source: Carson Investment Research

Conclusion

The statistics shown above speak for themselves: investors who put their savings to work following a stock market correction of 25% or more have been well rewarded for this in the past. And wasn't it Warren Buffett who said to buy “when there is blood in the streets”?

Obviously, past performance is not a 100% reliable indicator of future performance, but the next statement is, we believe, 100% true: fear and panic are very poor advisers when it comes to investing!