Is tighter monetary policy acting as a brake on the stock market upturn?

Keytrade Bank

keytradebank.be

February 23, 2022

(updated September 22, 2022)

4 minutes to read

Stock market sentiment has done a complete U-turn since the start of the year. While equity investors remained optimistic for 2022 at the turn of the year, the mood is now somewhat gloomier. Rising long-term interest rates appear to be the cause for the switch, with this increase being due to the fact that the US Federal Reserve (Fed) is expected to raise short-term interest rates several times in the coming year.

Does this signal the end of the stock market boom, or are investors unduly concerned? We take a look at previous periods that saw tighter monetary policy.

Many leading indices on the international stock markets are seeing a correction. In the US, in particular, indices with a high exposure to technology shares lost significant ground. Prices are under pressure as long-term interest rates are rising and

due to rising inflation, it is slowly becoming clear that the Fed will most likely consign its zero interest-rate policy to the bin from March. Most economists assume that we will see three to four interest rate hikes in 2022. And there are even some who believe we will see seven (yes, seven) interest rate hikes this year. But is this actually bad news for investors? Let's take a look back in time...

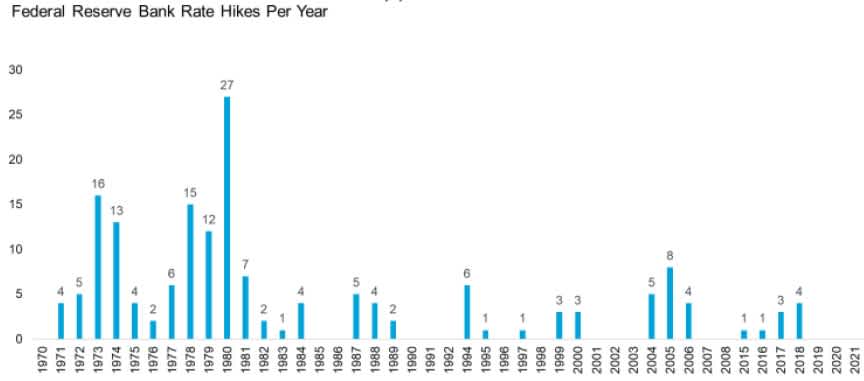

Figure 1 shows us that three or four interest rate hikes are not uncommon in the United States. 2004 to 2006 saw a period of tighter monetary policy, and the last interest rate hikes took place in 2017 and 2018. So, how did the US S&P 500 perform in the two most recent periods of higher short-term interest rates?

Figure 1: Interest rate hikes in the US (1970 – 2021)

Source: LPL Research

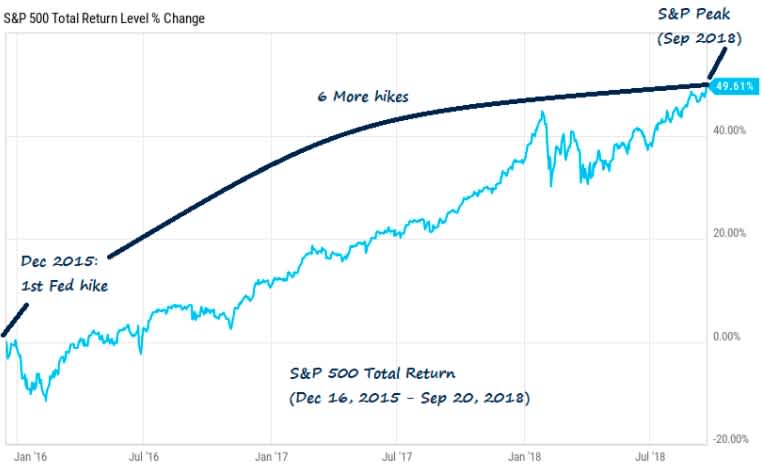

In December 2015, the S&P 500 was on an upwards trend. This is also the case today, as the primary US index has been on the up since March/April 2020. From December 2015 to September 2018, the Fed implemented six interest rate hikes in total. Although the start of 2016 saw a short dip, prices recovered quickly and the upwards trend continued throughout the entire period of tighter monetary policy. The S&P 500 saw a total return (price gains and dividends paid out) of 49.6% over the period as a whole (see Figure 2).

Figure 2: Price trends for the S&P 500 (2015 – 2018)

Source: Compound Advisors

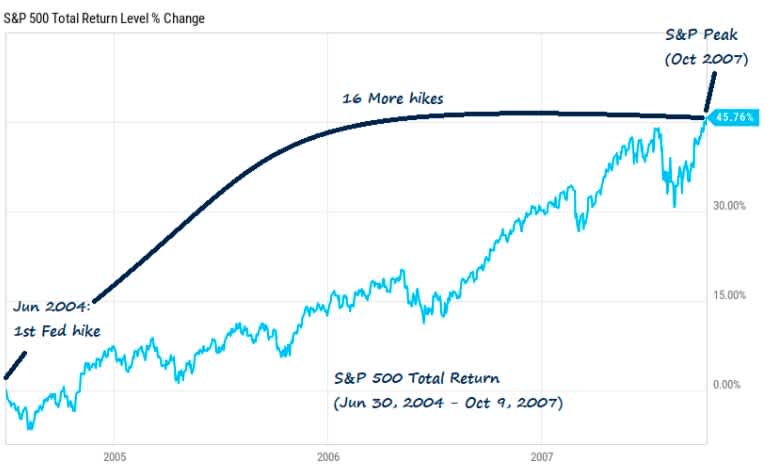

Just like in the last interest rate hike cycle, the S&P 500 was in a bull market – or experiencing an upwards trend – in June 2004. The US Federal Reserve then raised the short-term interest rate for the first time since 2000, raising it 0.25% from 1.00% to 1.25%. The S&P 500 made a small correction in the next two months, but quickly recovered any losses in the months that followed. A total of 16 interest rate hikes were implemented across this three-year period, with the S&P 500 gaining 45.8% over that time (see Figure 3).

Figure 3: Price trends for the S&P 500 (2004 – 2007)

Source: Compound Advisors

Past experience suggests that a period of tighter monetary policy doesn't have to mean the end of the world for equity investors. Interest rate rises are often seen as a way to prevent the economy from overheating and level out large shocks to economic growth.

In our

opinion, this is also the case at this time, as the global economy still appears to be growing and a recession doesn't appear to be on the horizon. Furthermore, the stock markets may even welcome an interest rate rise. Investors love certainty and can do without the uncertainty surrounding what will happen to interest rates in the future.

Table 1 shows that the S&P 500 is not affected by interest rate rises. If we look at the three-, six- and twelve-month figures, we see a positive price performance on average (+2.7%, +7.6% and +12.6%). In the previous eight periods of tighter monetary policy, the S&P 500 index was

still in the green twelve months later.

In other words, those who keep a cool head and don't panic get their reward.

Table 1: Price performance of the S&P 500 following an interest rate hike

Source: LPL Research

Conclusion

Most of the leading stock market indices have fallen since the start of the year. Those with a high exposure to technology shares (such as NASDAQ) were hit hardest by rising long-term interest rates,

which are going up in expectation of tighter monetary policy. Nevertheless, a period of higher short-term interest rates doesn't have to be a bad thing for equity investors. The figures show that the initial trepidation could quickly make way for a further rise on the markets.

Geert Van Herck Chief Strategist KEYPRIVATE