A potential worldwide trade war is claiming European victims

Geert Van Herck

Chief Strategist KEYPRIVATE

November 25, 2024

3 minutes to read

With the US elections over and Donald Trump the new president-elect, a period of uncertainty has come to an end for equity investors.

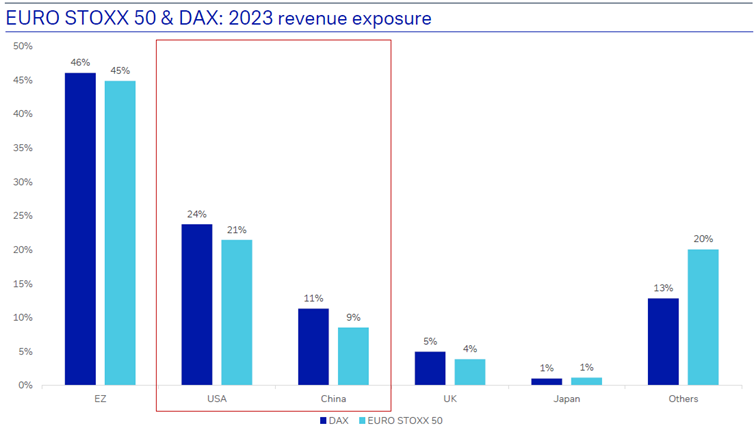

Euro Stoxx 50 & DAX index regional revenue exposure

Source: Deutsche Bank

Investors, economists and analysts will now start to quantify this election's impact on the equity markets. As you probably know by now, the introduction of import tariffs is an important aspect of Trump’s economic plan. For example, he wants to apply a general import tax of 10% – with the figure potentially rising to 60% for goods coming from China.

These and other possible trade measures have not been without consequences, of course. We have seen an immediate impact on the European equity markets. In the immediate aftermath of Trump’s victory, the European stock markets suffered losses while the US stock markets reached new record highs.

The question arises: Which companies are most at risk from a new US trade policy? In other words, who is currently generating a significant part of their revenue in the United States and China?

The thing to remember is that in the past decade, many European companies have set up Chinese production centres to supply the international market. Consequently, fewer Chinese exports to the United States could soon also affect the operations of European companies in China. Graph 1 shows that companies included in the Euro Stoxx 50 and the German DAX index generate around 22% of their revenue in the United States and 10% in China.

Why this focus on German companies?

Germany is still the export European champion and driving force of the European economy. Reduced German growth will therefore undoubtedly have a negative impact on the country's neighbours.

Which shares are most at risk from the expected higher US import tariffs?

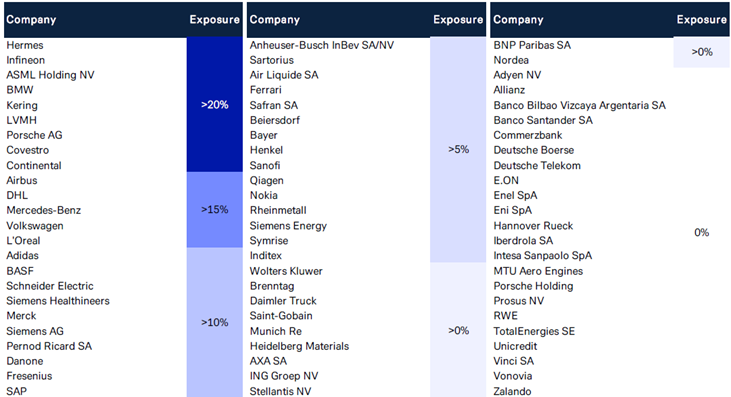

Tables 2 and 3 show that European car manufacturers deserve some extra attention. Volkswagen, BMW and Mercedes-Benz generate more than 20% of their revenue in the United States and more than 15% in China. European luxury brands could also suffer a negative impact.

It may be a good idea for investors to take a closer look at their portfolio as well. When it comes to investment, forewarned is forearmed.

US revenue of Euro Stoxx 50 & DAX companies

Source: Deutsche Bank

Chinese revenue of Euro Stoxx 50 & DAX companies

Source: Deutsche Bank