US stock market dominance not coming to an end yet!

Keytrade Bank

keytradebank.be

July 23, 2021

(updated January 24, 2022)

4 minutes to read

Since the end of the financial and economic crisis in 2009, US shares have performed much better than shares from other major economic regions. This performance is, of course, due to the big tech stocks in the US. Will this US dominance continue unimpeded or are other parts of the world ready to take over the leadership role?

Anyone who has focused on US shares in their investment portfolio in recent years will not be sorry they did. Over the past decade, US shares have far outperformed the rest, thanks to US tech in general and FAANG shares in particular (Facebook, Amazon, Apple, Netflix and Google). Those who mainly invested in European or emerging market shares (such as China or Brazil) achieved a lower return.

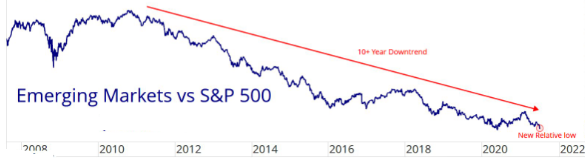

Graph 1 shows this US dominance by comparing the performance of emerging markets to the US S&P 500 index. A falling trend means that US shares are outperforming the emerging market shares. A rising trend would mean that they are performing less well than the emerging market shares. The conclusion is obvious: over the past ten years, investing in US shares has been much more rewarding than investing in emerging market shares. A turnaround seemed to be on the cards in 2020, but this turned out to be short-lived and we have recently seen a new low for the emerging markets on this graph, which once again confirmed the US' relative strength.

Graph 1: emerging markets vs S&P 500

Source: All Star Charts

Graph 2 shows the recent relative performance of the S&P 500 compared to the other Western stock markets (Europe and Japan). Here, a rising graph means that US shares outperformed European or Japanese shares. A falling graph would mean the opposite. Again we can see how 2020 seemed to be a turning point, but then recently US equities rallied and set a new record in terms of their relative performance.

Graph 2: S&P 500 vs rest of the world

Source: All Star Charts

So as investors, should we all be focusing entirely on US equities? We believe that a number of elements suggest that a changing of the guard is near:

- US tech stocks have benefited from a fall in long-term interest rates. Over the past year, we have seen a sharp rise in US long-term interest rates, which has been troublesome for the tech industry. If the long-term interest rate continues to rise in the years ahead, the tech industry (which benefits from low interest rates because of its constant need for new investments) will find things more difficult.

- Based on traditional valuation measures (such as the price-to-earnings ratio or dividend yield), the US stock market is heavily overvalued, whereas Europe and the emerging countries are not. Low valuations indicate a higher expected return. High valuations indicate a lower expected return.

- Higher interest rates benefit cyclical and financial shares. These shares are strongly represented in the European stock market indices. A structurally rising interest rate trend is therefore more advantageous to European shares than it is to US shares.

Conclusion: nothing lasts forever and stock markets have always been characterised by cycles that go up and down. We are expecting European shares and emerging market shares to rebound in the years ahead. This does not mean that US equities should be sold, but in a global diversified equity portfolio we would reduce the exposure to US equities somewhat compared to European shares or emerging market shares.

Geert Van Herck Chief Strategist KEYPRIVATE