Will the MSCI Emerging Markets index become the next big thing?

Geert Van Herck

Chief Strategist KEYPRIVATE

August 24, 2020

(updated January 24, 2022)

4 minutes to read

Investors who have an overexposure to US shares in their portfolio have not been complaining in recent years. The US stock market has proved to be the top star performer by some way. It has outperformed the European stock markets and those of emerging countries such as China and India. This is primarily due to the technology sector!

Will the party continue? Or are we about to witness a changing of the guard? A brief analysis by Geert Van Herck, Chief Strategist at Keyprivate.

“The US stock market has easily outperformed the stock markets of Europe and of emerging countries such as China, India, South Africa, South Korea and Russia in recent years. This strong performance by the US was delivered by technology companies such as Apple, Amazon, Microsoft, Facebook, Google and Netflix. Many stock market analysts are increasingly wondering whether the US can continue this over the next five to ten years.

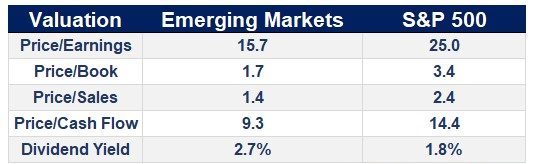

The flip side of the coin is the fact that the US stock market's success has made it expensive according to many well-known valuation ratios. Table 1 shows five common valuation ratios for the S&P 500 compared to the MSCI Emerging Markets. More and more stock market analysts are seeing potential in these emerging countries. Their modest performance over the past few years makes them seem cheap. However, valuation is and remains an important criterion for projected returns. The cheaper they are, the higher the expected returns from investments in different economic regions. On the other hand, the more expensive they are, the lower the returns.

Table 1: S&P 500 versus MSCI EM valuation

Source:Vanguard

Note:

- Price/Earnings = share price/earnings

- Price/Book = share price/asset book value

- Price/Sales = share price/turnover

- Price/Cash Flow = share price/cashflow

- Dividend Yield = dividend payments

The valuation overview in Table 1 makes it clear that emerging countries could be attractive for investors. This makes it all the more striking that although the MSCI Emerging Markets is cheap, a number of big names from the technology sector are heavily weighted in the index. As in the US, the technology sector is the largest one in the index (see Table 2), but it can be bought a good deal more cheaply here. The 10 biggest names from the index. include well-known names such as Alibaba and Samsung. These companies have taken over the role of, for example, the Brazilian oil company Petrobras or other large commodity companies that have been determining the ups and downs of emerging countries for many years."

Table 2: S&P 500 (SPY) versus MSCI EM (EEM) sector weightings

Source: iShares & Vanguard

What can we conclude from this?

The champagne performance of the US stock exchange has made it expensive. What has remained under the radar is the fact that technology lovers can now enter this sector cheaply via stock exchanges in emerging countries. This is easily done using a tracker. We have already taken an initial position for our KEYPRIVATE discretionary asset management in the more dynamic profiles.

Other articles that might interest you

ChatGPT as financial adviser: reliable or not?

Valentine’s rally: romance meets precious metals

Stock market romance: profiting from Valentine’s Day?

Investing in the $1,000 club

Why you should pay in the maximum amount to your pension savings in January

From siestas to sprints, the Spanish stock market surprises investors

Is it time to say goodbye to bonds?

Capital gains tax: how will it affect your portfolio?

Will AI replace human investment advisers?

How can I invest or save better for my child?

Buying or renting after you turn 50: which option is best for your future plans?

Is a buy-to-let property a smart investment?

How much can you borrow for a home?

Borrowing for a second home: what are your options?

Property shares: ripe for a comeback?

10 tips for the novice property investor

Investing in your partner’s home? Don’t make these mistakes!

Ever heard of the Zweig Breadth Thrust?

Humanoid robots: hype or golden opportunity for investors?

Defensive shares as a buffer?

A beginner's guide to buying shares in five steps

Investing when money is tight: being ambitious pays off!

40 years of pension savings: what will you spend it on (literally)?

From FOMO to ZERO bank account? 5x pension savings to the rescue

Start growing your pension sooner rather than later

Pension savings returns: these choices give the maximum payout

Why pension planning is even more important for women

United States 1, Everyone Else 0

When should you start investing? Seven potential key moments in your life

What type of investor are you? Take the quiz

Did you just purchase shares? Why you should immediately set a stop-loss

Are there shortcuts to becoming financially independent?

A potential worldwide trade war is claiming European victims

Ever thought of investing in the pet industry?

Have long-term interest rates once again started a 40-year uptrend?

8 years of Keyprivate: let's take stock

Graph of the Week: Magnificent 7 vs 2000s Tech Bubble

5 mistakes investors make in volatile markets

Government bonds, savings accounts, or term accounts: which should you choose?

House flipping: is it worthwhile?

Investing in dividend shares: what to look for?

Why high dividend yields can be a poisoned chalice

3 ways to invest when you don't have much time.

How do you select an investment fund for your child?

Robotics: From science fiction to science

Coronablog by Geert Van Herck: Market Observations

Is it the right time to invest in bonds?

Have you ever thought about investing for your children?

How can you invest in space travel?

What do you have to tell the tax man about your money and investments?

Five myths about sustainable investing

How can you invest in an ageing population?

6 reasons why installing solar panels is still worthwhile in 2024

How do elections affect the stock market?

Golden days? Why to invest in gold (or not)

Investing in emerging markets: are investment funds a smarter buy than trackers?

Watch out, danger's about

How to invest in the energy transition?

Is India the new China?

Which sectors should remain overweight following the latest rate hike?

Keytrade Bank chose SOPIAD to integrate a ‘sustainable preferences module’ in Keyprivate

8 timeless rules for investors

Saving for the sake of saving? Or with a goal in mind?

How do you prepare financially for a longer life?

How natural disasters affect the economy and the markets

Which investment opportunities are available on the road to smart mobility?

A vitamin shot for your investments

Does water earn a place in your portfolio?

Bonds to rise in 2023?

Investors? Do you want to remain on the sidelines now?

Is tighter monetary policy acting as a brake on the stock market upturn?

Getting nervous about the stock market? Take a look at the 200-day moving average

With or without the coronavirus: why green investing remains just as relevant as before

Impact investing: sustainable investments with that little bit more

Sustainable investing: what, why and how?

How can you make an investment portfolio inflation-resistant?

CARD STOP has a new number! 078 170 170

Five tips for keeping a cool head when the stock market becomes turbulent

How do I choose the right shares?

Short selling: what is it and how does it work?

10 things you can do within a day to improve your financial health

How to protect your capital in the event of a divorce

Timing is everything: how to choose the right time to enter the stock exchange?

Why (not) invest in micro-caps?

Rising debt: is it a problem?

Funds and trackers: do you opt for capitalisation or distribution?

Can I invest even if I do not have a large sum of money available?

What do I do to balance my investments?

CARD STOP has a new number! 078 170 170

Talking to your family about legacy: how to get started

Always have a megatrend in your portfolio

The lazy marathon investor

Equity investors look beyond gloomy economic data

Are we heading into a year-end rally by the stock markets?

Coronavirus blog by Geert Van Herck: S&P 500 indicates a positive trend

What retirement pension will you get later?

How can we cope with financial stress?

US stock market dominance not coming to an end yet!

Going for gold? Gold is apparently going for it.

Are you a contrarian investor?