Equity investors look beyond gloomy economic data

Geert Van Herck

Chief Strategist KEYPRIVATE

February 21, 2019

(updated February 09, 2022)

4 minutes to read

For several months now, no one has been able to deny that the global economy is slowing down. The PMI indicators are showing a downward trend. Manufacturing is experiencing a dramatic fall in some key industries. And yet the stock markets have been rising fast since the start of 2019. So what is going on?

Manufacturing confidence is down

One of the most popular economic indicators is international manufacturing confidence. The JPMorgan PMI indicators as published by global information provider IHS Markit each month are a good predictive indicator for investors. What happens is that when manufacturing confidence goes up, the global economy tends to grow, and when manufacturing confidence goes down, the global economy tends to shrink. The magical 50-point mark is very important in this respect: a manufacturing PMI above 50 points marks an expansion in economic activity and one below 50 points indicates a contraction.

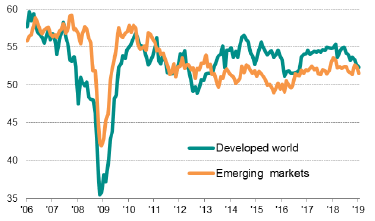

Graph 1 shows the evolution of manufacturing confidence in the Western world (USA, Europe and Japan, green line) and the emerging markets (including China, Brazil, Russia and India, orange line). So what do we see? A downward trend since the beginning of 2018, both for the West and for the emerging markets. This negative evolution clearly points in the direction of a slowdown in economic growth. So is there reason to panic? Not really.

You probably know that the global economy rises and falls in cycles and that manufacturing confidence rose considerably in 2016 and 2017. It is to be expected that a period of economic boom is followed by a period of economic downturn. We can also immediately see that manufacturing confidence in both regions is not in any danger of falling below the 50-point mark just yet.

A global recession does not seem likely any time soon.

Graph 1: Evolution of economic activity

Source: IHS Markit

Manufacturing is falling even more quickly

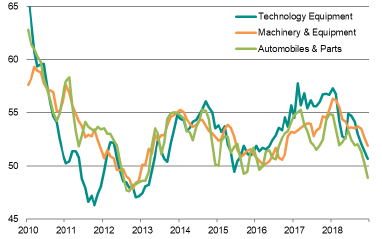

However, the rapid fall in manufacturing in a number of important key industries of the world economy is a little more worrying. Graph 2 shows industrial activity in the technology, mechanical engineering and automotive sectors. We see that activity in these industries has been falling very rapidly since the start of 2018. Falling activity is not necessarily a problem as such, as these are highly cyclical industries.

It is mainly the speed of the decline that deserves our attention. For example, we can see that activity in the automotive industry has already fallen below the 50-point mark. This is associated with certain risks. One of these risks is the impact on other businesses. If the automotive industry is not doing well, this nearly always affects the suppliers.

Graph 2: Evolution of activity in key sectors of the global economy

(3 month average)

Source: IHS Markit

And yet the stock markets are on the rise

Despite these disappointing indicators, we have seen a sharp rise in the stock markets since the start of the year. This seems contradictory to say the least. Surely a decline in growth would lead to lower profits for listed companies? So why are investors suddenly so interested? Why are the stock markets going up? Why are equity investors pressing the 'Buy' button?

To answer these questions, we mustn't lose sight of the fact that stock markets mainly look towards the future. Investors reason that slower growth will probably mean that the central banks – led by the US Fed – will not raise short-term interest rates any further in the coming months. Consequently, long-term interest rates are also falling. Fixed-income products are no longer a viable alternative and stocks are attracting new cash flows.

We think this is the only valid explanation for the current bull market.

Other articles that might interest you

ChatGPT as financial adviser: reliable or not?

Valentine’s rally: romance meets precious metals

Stock market romance: profiting from Valentine’s Day?

Investing in the $1,000 club

Why you should pay in the maximum amount to your pension savings in January

From siestas to sprints, the Spanish stock market surprises investors

Is it time to say goodbye to bonds?

Capital gains tax: how will it affect your portfolio?

Will AI replace human investment advisers?

How can I invest or save better for my child?

Buying or renting after you turn 50: which option is best for your future plans?

Is a buy-to-let property a smart investment?

How much can you borrow for a home?

Borrowing for a second home: what are your options?

Property shares: ripe for a comeback?

10 tips for the novice property investor

Investing in your partner’s home? Don’t make these mistakes!

Ever heard of the Zweig Breadth Thrust?

Humanoid robots: hype or golden opportunity for investors?

Defensive shares as a buffer?

A beginner's guide to buying shares in five steps

Investing when money is tight: being ambitious pays off!

40 years of pension savings: what will you spend it on (literally)?

From FOMO to ZERO bank account? 5x pension savings to the rescue

Start growing your pension sooner rather than later

Pension savings returns: these choices give the maximum payout

Why pension planning is even more important for women

United States 1, Everyone Else 0

When should you start investing? Seven potential key moments in your life

What type of investor are you? Take the quiz

Did you just purchase shares? Why you should immediately set a stop-loss

Are there shortcuts to becoming financially independent?

A potential worldwide trade war is claiming European victims

Ever thought of investing in the pet industry?

Have long-term interest rates once again started a 40-year uptrend?

8 years of Keyprivate: let's take stock

Graph of the Week: Magnificent 7 vs 2000s Tech Bubble

5 mistakes investors make in volatile markets

Government bonds, savings accounts, or term accounts: which should you choose?

House flipping: is it worthwhile?

Investing in dividend shares: what to look for?

Why high dividend yields can be a poisoned chalice

3 ways to invest when you don't have much time.

How do you select an investment fund for your child?

Robotics: From science fiction to science

Coronablog by Geert Van Herck: Market Observations

Is it the right time to invest in bonds?

Have you ever thought about investing for your children?

How can you invest in space travel?

What do you have to tell the tax man about your money and investments?

Five myths about sustainable investing

How can you invest in an ageing population?

6 reasons why installing solar panels is still worthwhile in 2024

How do elections affect the stock market?

Golden days? Why to invest in gold (or not)

Investing in emerging markets: are investment funds a smarter buy than trackers?

Watch out, danger's about

How to invest in the energy transition?

Is India the new China?

Which sectors should remain overweight following the latest rate hike?

Keytrade Bank chose SOPIAD to integrate a ‘sustainable preferences module’ in Keyprivate

8 timeless rules for investors

Saving for the sake of saving? Or with a goal in mind?

How do you prepare financially for a longer life?

How natural disasters affect the economy and the markets

Which investment opportunities are available on the road to smart mobility?

A vitamin shot for your investments

Does water earn a place in your portfolio?

Bonds to rise in 2023?

Investors? Do you want to remain on the sidelines now?

Is tighter monetary policy acting as a brake on the stock market upturn?

Getting nervous about the stock market? Take a look at the 200-day moving average

With or without the coronavirus: why green investing remains just as relevant as before

Impact investing: sustainable investments with that little bit more

Sustainable investing: what, why and how?

How can you make an investment portfolio inflation-resistant?

CARD STOP has a new number! 078 170 170

Five tips for keeping a cool head when the stock market becomes turbulent

How do I choose the right shares?

Short selling: what is it and how does it work?

10 things you can do within a day to improve your financial health

How to protect your capital in the event of a divorce

Timing is everything: how to choose the right time to enter the stock exchange?

Why (not) invest in micro-caps?

Rising debt: is it a problem?

Funds and trackers: do you opt for capitalisation or distribution?

Can I invest even if I do not have a large sum of money available?

What do I do to balance my investments?

CARD STOP has a new number! 078 170 170

Talking to your family about legacy: how to get started

Always have a megatrend in your portfolio

The lazy marathon investor

Are we heading into a year-end rally by the stock markets?

Coronavirus blog by Geert Van Herck: S&P 500 indicates a positive trend

What retirement pension will you get later?

How can we cope with financial stress?

US stock market dominance not coming to an end yet!

Will the MSCI Emerging Markets index become the next big thing?

Going for gold? Gold is apparently going for it.

Are you a contrarian investor?