Gold, cash and government bonds: how safe are safe havens?

Keytrade Bank

keytradebank.be

May 13, 2021

(updated August 06, 2022)

7 minutes to read

In theory, safe havens are investments that will retain their value in a turbulent market environment. They may even increase in value in volatile times. Investors often run towards such safe havens when a recession or crisis looms. And yet those safe havens are not really as risk-free as we may think.

Myth 1: gold is always a stable investment.

Demand for gold often rises when the financial markets get nervous. For example, when on 24 June 2016 the results of the Brexit referendum gradually came in, stock prices plummeted and the price of gold soared.

Investors often see gold as a life raft, because it is a rare precious metal and cannot go up in smoke in times of a financial crisis. It is also impossible to increase the supply of gold at the push of a button in the way the money supply can be increased.

However, gold is not as stable as is often thought. Gold can even be very volatile. Its price is determined not only by supply and demand, but also i.a. by the exchange rate of the American dollar.

Gold also has another limitation as a safe haven: it does not generate any income in the way dividend shares, bonds and even savings do. Buying and holding physical gold is also very expensive, even though you can now invest in gold without a safe or a security guard with the help of i.a. trackers and other tools.

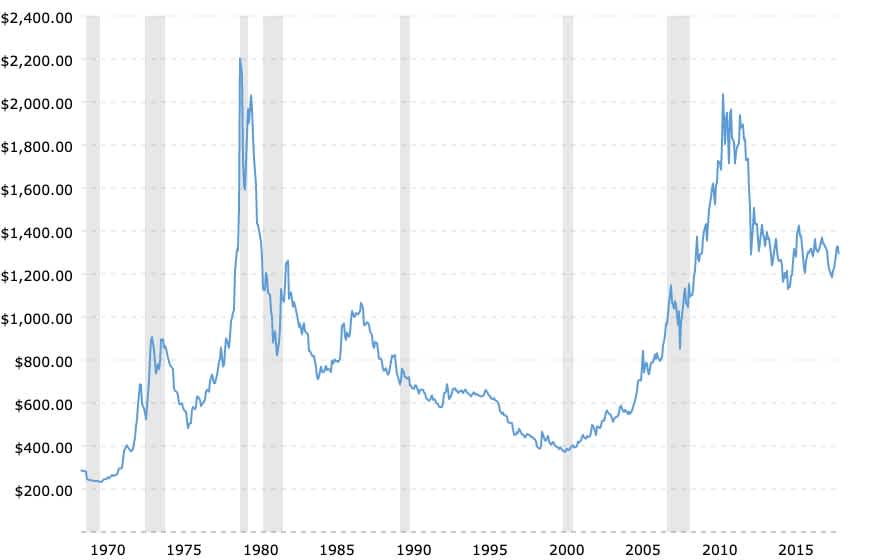

Changes in the price of gold per ounce (28.35 grams) - adjusted for inflation

Source graph: macrotrends.net

The grey bars are periods of recession. They show that gold is not always a miracle solution in turbulent times. The return is also very volatile in the long term. So is gold stable? No.

Myth 2: You can never lose with cash

Cash is often regarded as the ultimate safe haven, whether the stock market is going through a rough time or not: the return on savings is stable and predictable to a large extent. In Belgium, you are also covered by the deposit guarantee system of the Guarantee Fund. In the event your bank goes bankrupt, this system guarantees up to 100,000 euros per account holder per bank. For example, if you are holding 100,000 euros with bank A and 200,000 euros with bank B together with your partner, all 300,000 euros are protected.

Nevertheless, cash is associated with a considerable risk: the risk of inflation. In March 2016, the interest rate on most savings accounts in Belgium fell to 0.11%. But while the interest rate has remained very low for several years, inflation is rising and is currently around 2%. This means that while you pay an average 2% more for things such as new shoes, a box of apple juice and a phone plan each year, your savings are increasing far less quickly. The chance that the interest rate on savings in Belgium will also rise significantly over the next few years is almost zero.

| empty-header | empty-header | empty-header |

|---|---|---|

Interest on most Belgian savings accounts | Inflation year by year | |

March 2019 | 0,11% | 2,33% |

March 2018 | 0,11% | 1,39% |

March 2017 | 0,11% | 2,28% |

March 2016 | 0,11% | 2,24% |

Myth 3: the dollar, the yen and the Swiss franc are predictable currencies

Currency market investors often resort to the US dollar, the yen and the Swiss franc in times of turmoil. The USD is often the first currency of choice. This is because it is the best tradable currency and the US economy is the largest in the world. The US dollar therefore has world reserve currency status.

Changes in the EUR-USD exchange rate

Source graph: macrotrends.net

Although the USD is one of the safest currencies, its value fluctuates considerably at times.

The yen is also regarded as a popular safe haven: of the most traded foreign currency pairs, the US dollar is in first place and the yen in second place. That is remarkable given Japan's low inflation, years of economic stagnation and huge government debt. Of course the yen is easily tradable and investors regard Japan as a safe and stable country.

Changes in the EUR-JPY exchange rate

Source graph: macrotrends.net

Over the past 20 years, the value of the yen has gone up or down by more than 5% against the euro 14 times.

Evolution of the EUR-CHF exchange rate

Another currency with safe haven status is the Swiss franc. In times of trouble, investors like to resort to the currencies of neutral, stable countries with economies not highly sensitive to international developments. Switzerland fits the bill perfectly, even if the tradability is relatively small.

Source graph: macrotrends.net

The Swiss are not so happy with their currency's status as a safe haven. A rise in the Swiss franc erodes the competitive position of Swiss companies. As a result, the Swiss central bank has repeatedly intervened to reduce the value of the franc, as shown in the graph.

Currency investors holding so-called safe haven currencies should therefore take into account possible fluctuations.

Myth 4: bonds - and government bonds in particular - are risk-free.

When you buy a bond, you are actually lending money to the issuer, usually a government or a company. In exchange, you receive regular interest payments ('coupons'). When the bond matures, the company or government will pay you back the borrowed capital.

Bonds are generally associated with less risk than shares. In the event of a bankruptcy, any funds still remaining will first go to the ordinary creditors (such as suppliers), then to the bondholders and only then to the shareholders.

Although corporate bonds are considered more risky than government bonds, some countries (Greece, Argentina, Venezuela and so on) have been unable to make the repayments in the past. This so-called counterparty risk therefore also exists for government bonds.

Just like savings, bonds are associated with an inflation risk. Bonds guarantee a certain nominal interest rate. If you deduct the inflation from this nominal interest rate, you obtain the real interest rate. The higher the inflation, the lower the real interest rate will be.

If you are investing in bonds in foreign currencies, there is also a currency exchange rate risk. And then there is also the liquidity risk: that is the risk that an investment product is not tradable when the time and price are right for you. One cause for this is that you may want to sell your investment, but no buyers are interested. Finally, the bond rating may also be adjusted, which will result in a change in their value.

What now

Investments are long-term endeavours. If turbulent markets are preventing you from investing, then a periodic investment plan such as KEYPLAN may be a solution for you. It allows you to invest in different funds spread over time.