Graph of the week: Industry has not succumbed to Trump!

Geert Van Herck

Chief Strategist KEYPRIVATE

September 18, 2025

3 minutes to read

Donald Trump being elected president of the US created a lot of unrest. Many economists believed his instigation of higher import tariffs would reduce growth. Meanwhile, despite some threatening language from all sides, most countries have signed 'new' trade agreements with the US resulting in 15% import tariffs for European companies.

How has this clarity affected manufacturing confidence? Has it recovered?

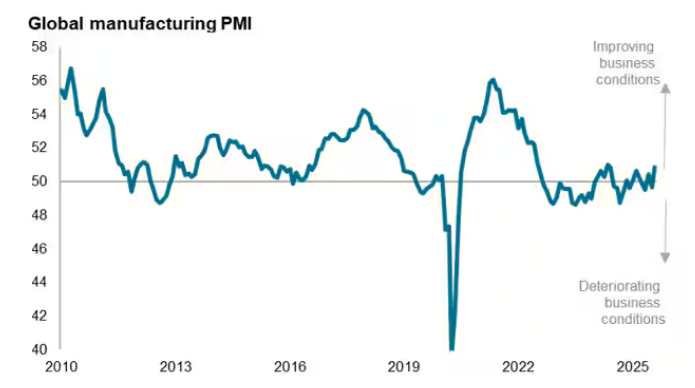

As always, let's start by a look at changes in the 'Global Manufacturing PMI'. This index measures confidence among business managers operating in industry around the world.

When the monthly figures are published, economic observers are most interested in the 50 level. A value above 50 points indicates an expansion of industrial activity. Below 50 points, activity has shrunk.

Graph 1 shows this confidence indicator rising above 50 points to 50.9 points in August 2025. This is the highest it has been since June 2024, and also a sign to expect a return to growth by the severely distressed industrial sector.

Graph 1: Trend in global manufacturing confidence (industry)

Source: S&P Global

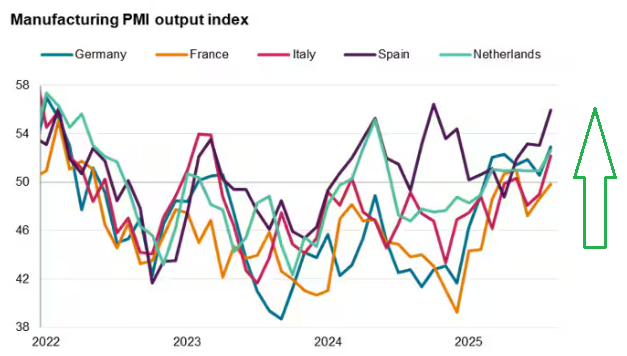

If we stay closer to home and look at changes in European industrial manufacturing confidence, we again see a very positive trend. As Graph 2 shows, there has been a strong recovery by Europe's main industrialised countries, including Germany, France and Italy, since the beginning of this year.

This is undoubtedly related to Germany's announcement of greater investments in defence and infrastructure. After all, if the German economy is up to speed again, that also affects the rest of Europe. We will be interested to see whether this recovery continues and euro-pessimism is replaced by optimism.

Graph 2: Trend in European manufacturing confidence

Source: S&P Global

In short, the uncertainty about Trump and his trade policy seems to be ebbing. Business managers are clearer on what the new import tariffs involve. Industrial manufacturing confidence is picking up again as growth returns, and investors are feeling confident about the future.

This is confirmed by new record values for important indices such as the US S&P 500 and European Euro Stoxx 50. For the first time in many years, US equities are lagging behind European ones (and also behind the Chinese).

Investors seeking to take advantage of this cyclical recovery should have a look at European cyclical companies and 'small caps' (companies with a smaller market capitalisation).