Will the central banks change track?

Keytrade Bank

keytradebank.be

December 20, 2022

(updated March 21, 2024)

6 minutes to read

In 2022, central banks in the West took a different approach to that seen in recent years. Rapidly rising inflation consigned low interest-rate policies to the bin, with strict monetary policy taking their place. Short-term interest rates surged in both the United States and the eurozone.

The latest macroeconomic figures suggest that there's a greater chance of us seeing an increasingly modest monetary policy in 2023.

2022 will go down in the history books as the year of normalisation, bringing in a new era for monetary policy in general, and for the US and the eurozone in particular. After years of the US and European central banks supporting economic growth by keeping short-term interest rates at 0% on the one hand, and by buying long-term bonds to avoid long-term interest rates rising, on the other, we saw the beginnings of an opposite trend in 2022. As inflation in the West hit – and passed – 10%, central bankers hiked up short-term interest rates to curb economic growth. The aim is to get inflation down to more manageable levels in 2023.

While many economists are still working on the assumption that further rate hikes will come, we take a different view. We believe that an end to the cycle of monetary tightening is around the corner. This belief is based on recent monthly reports on global manufacturing confidence, in which business leaders from around the world provide insights into trends in their purchase and sales prices. Needless to say, pricing policies are closely linked to Western inflation figures. When manufacturers have to pay more for their raw materials (their most significant input cost), they will try to pass such additional costs on to their customers. This in turn creates a cycle of higher prices (in other words, inflation).

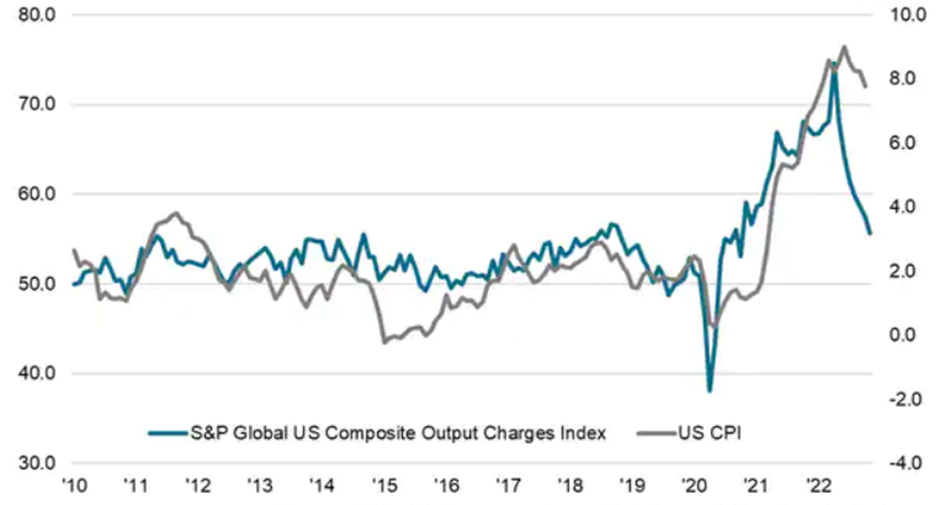

Figure 1, however, shows that the cycle of rising prices has come to an end. Due to the drop in commodity prices in recent months, American companies no longer need to pass the higher commodities bill on to their customers. This also means that sales prices (blue line) have fallen dramatically. The high correlation with the official inflation figure (grey line) means that we expect inflation to be lower in the months ahead. Lower inflation will ease the pressure on the US central bank to raise short-term interest rates even further.

Figure 1: Trend in US sales prices and inflation

Source: S&P Global, JPMorgan

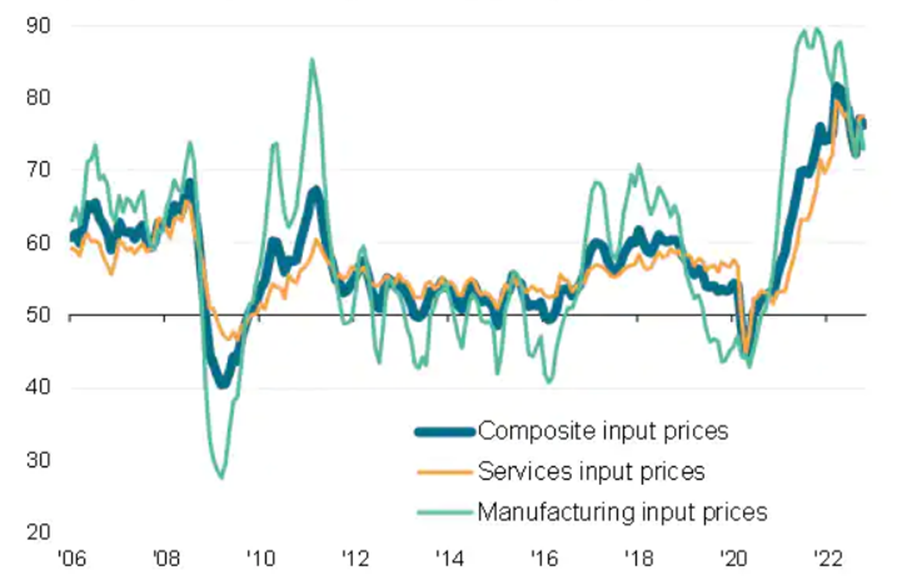

We see the same phenomenon occurring in the eurozone. Figure 2 shows the trend of input prices for companies in the eurozone (the grey line represents the industrial sector, the orange line represents the services sector, and the thick blue line represents both sectors combined). The companies' significant purchases are raw materials such as energy, steel, chemical products and so on. Commodities prices have been on a downward correction since the summer, pushing down commodities bills. As a result, companies in the eurozone (just like their US counterparts) no longer have to hike up their sales prices, which has cooled European inflation figures. This could lead to the European Central Bank reducing their monetary tightening policy.

Figure 2: Trend in input prices in the eurozone

Source: S&P Global, JPMorgan

Conclusion

The correction on the international commodities markets has meant that US and European companies are no longer obliged to increase their sales prices significantly to recover any higher costs incurred.

On the contrary, a move appears to have started in the opposite direction. Western companies are no longer increasing their sales prices, which in turn reduces any inflationary pressure. Investors are already assuming that the monetary tightening policy is coming to an end, while confidence is returning – partly due to the rising stock markets seen in recent months.

We expect the stock markets to get off to a good start in the New Year.