The situation following the Russian invasion of Ukraine

Keytrade Bank

keytradebank.be

March 04, 2022

(updated September 22, 2022)

4 minutes to read

In the final days of February 2022, Russia attacked neighbouring Ukraine. We cannot stress enough how this action has had a major impact on the financial markets. This geopolitical crisis will also leave its mark on the global economy. In this brief analysis, we take a moment to consider the impact on the global economy and on the rotations of the financial markets.

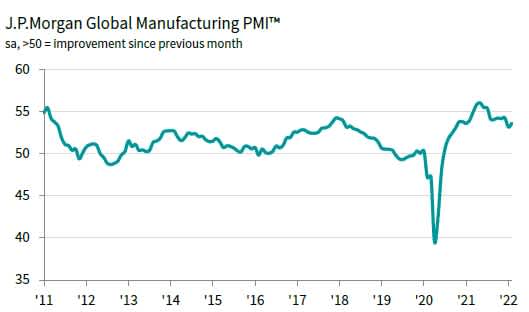

The Russian invasion of Ukraine is still in its infancy and its economic impact will continue to be felt for some time yet. But to understand the initial impact, we are looking primarily at the trends in international producer confidence from among our economic indicators. International producer confidence is published in the J.P.Morgan Global Manufacturing PMI. This indicator is based on the replies to a questionnaire taken by 13,500 companies worldwide. For the latest update to the indicator (published on 1 March 2022), the questionnaire was sent out in the first weeks of February 2022. The war was not yet in progress at that time, but there was already considerable global concern. In February 2022, the J.P.Morgan Global Manufacturing PMI reached 53.6 points, which was slightly higher than in January 2022 (53.2 points) and above 50 points (indicating an expansion in industrial activity).

Figure 1: The evolution of global manufacturing confidence in industry

Source: IHS Markit

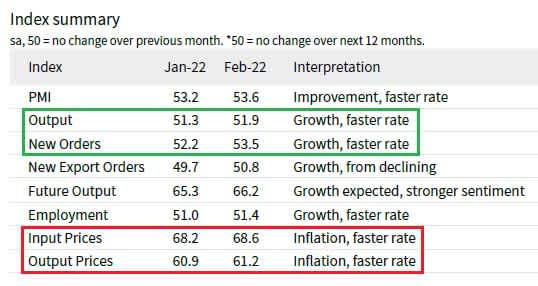

If we look in more detail at the various sub-indices of the J.P.Morgan Global Manufacturing PMI, we see little reason to feel nervous about the immediate economic future. For instance, we can observe a welcome increase in current production (output) and pipeline (new orders) among companies. To see this, consult the green box in Table 1. What does demand our attention, though, is the continued high level of prices (red box in Table 1). But this is nothing new: the global economy has been struggling for some time with high inflation figures, and this crisis will exacerbate this trend through further increases in oil prices.

Table 1: J.P.Morgan Global Manufacturing PMI sub-indices

Source: IHS Markit

To date, we have not yet seen any negative impact of the international crisis on business confidence. However, in the coming weeks we must expect that

- both the oil price and the price of agricultural commodities will have risen further as a result of the conflict in Ukraine. This will undoubtedly push inflation up further and could have a negative impact on consumer spending in the West.

- The logistics chain has been disrupted for companies that do business with Russia. This may have a negative impact on industrial production.

- The fall in prices on the international stock markets could have a negative impact because investors feel they are “less rich”.

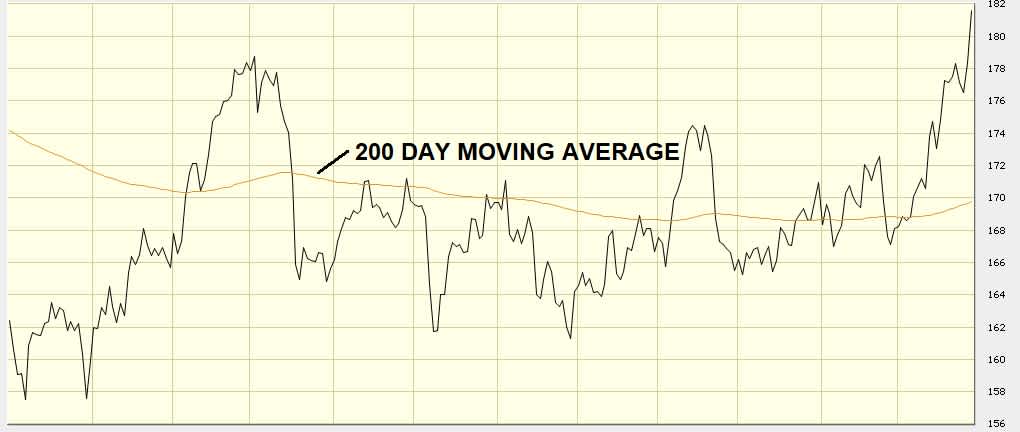

In economic terms, we are not seeing an immediate impact, but the impact on the financial markets is already very strong. As expected, the stock markets fell and investors turned to defensive asset classes such as gold. On the international stock markets, prices fell: an important feature of the effect on the major stock market indices is that they all fell below their 200-day average. The 200-day moving average (the sum of the closing prices over the past 200 days divided by 200) is regarded as a trend indicator: if the price of a share or an index is above (below) this average, this indicates a rising (falling) trend. You are often recommended to reduce your equity exposure slightly if prices fall below the 200-day moving average. In the current circumstances, it pays to have less exposure to equities and more cash in your portfolio. Figures 2 and 3 show the trend of the Euro Stoxx 50 (the 50 most important shares in the euro zone) and the Nasdaq (which includes the major US technology shares), and their respective 200-day averages.

Figure 2: Euro Stoxx 50

Source: Big Charts

Figure 3: Nasdaq

Source: Big Charts

Investors have pushed the sell button for shares, but other things, including the gold price, have had buyers lining up. Figure 4 clearly shows the rising trend for gold: the precious metal is well above its 200-day average. This also applies to many other commodities: both oil prices and those for industrial metals and agricultural commodities are on the rise. This is not illogical, as Russia is a major producer and exporter of many commodities. And Ukraine is considered to be the grain basket of the world.

Figure 4: Gold price

Source: Big Charts

Figure 5: Industrial metals

Source: Big Charts

Conclusion

To date, we have seen more of the same in macroeconomic terms. By this, we mean that economic growth remains buoyant and inflation is high. This is a theme that has been around for several months and it has not yet been altered by the geopolitical crisis. However, we need to wait and see over the coming weeks how the conflict will affect consumer confidence. If consumers start spending less, there will undoubtedly be a dip in industrial activity.

On the financial markets, we have seen a fall in the stock markets on the one hand, and an increase in the price of gold and industrial metals on the other. One important point is that many leading indices are currently below their 200-day average. This indicates a falling trend, which is why we consider it fairly logical to have more cash in the portfolio by reducing equity positions. We would only revert to shares once prices rise back above the 200-day moving average.