Sell in May? Is it really such a good idea?

Geert Van Herck

Chief Strategist KEYPRIVATE

May 14, 2023

(updated May 22, 2023)

4 minutes to read

Sell in May and go away ...is the best-known saying in stock market circles. But does this strategy really work? Should investors sit on the sidelines for the next few months? Or are they better off staying in the market?

May has started with all sorts of warnings from the financial media about a possible recession, with a banking sector in the US that has been shaken to its core and European fears of a return of inflation. So sure, why not decide against nurturing a nest egg and selling up instead? A few statistics from the S&P 500 tell us why running away might not be such a good idea.

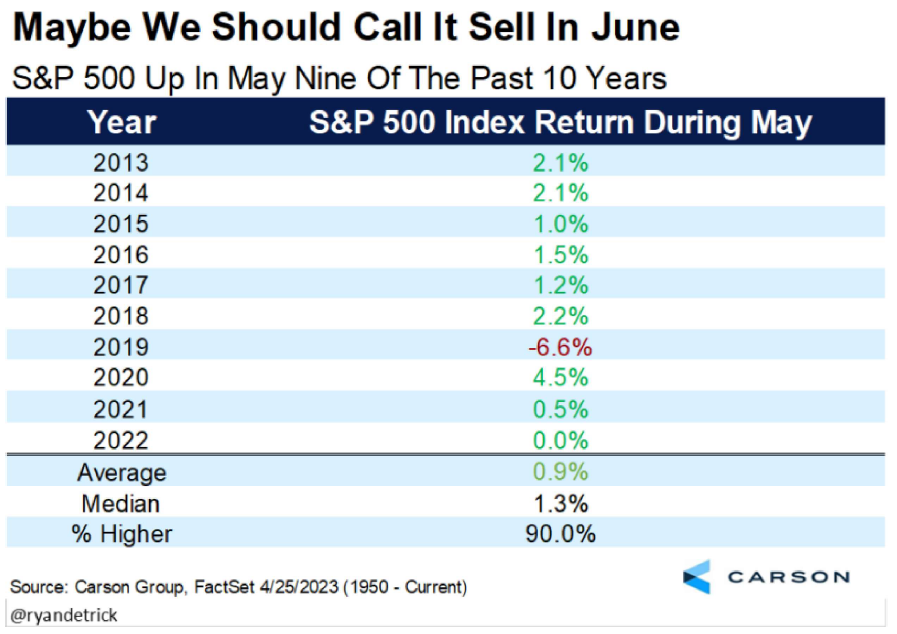

Table 1 shows us that the returns for the month of May have been positive (or zero) for nine of the last ten years. Only 2019 shows a negative return. On average, you would have made 0.9 percent gains with the S&P 500. That’s not really a reason to sell, if you ask us.

Table 1: sell in June?

Source: Carson Research

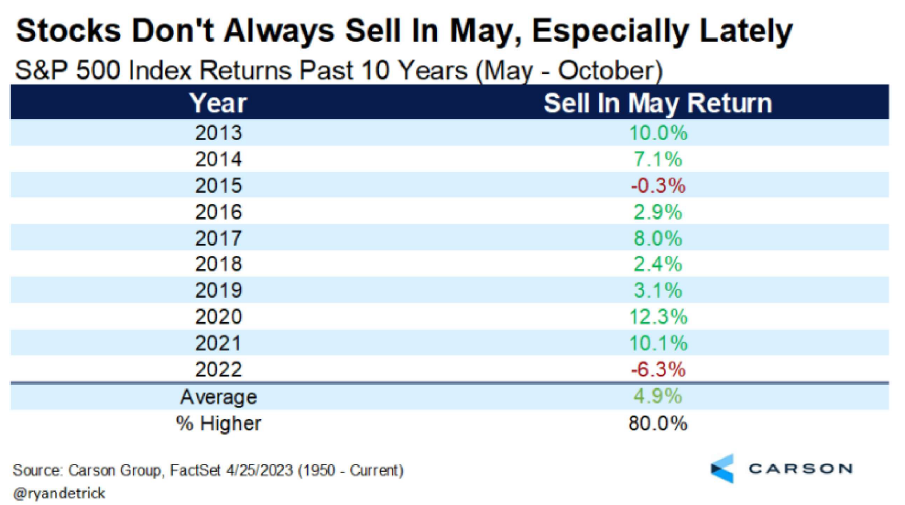

Table 2 has more information. This one gives us an overview of the returns from May to October for the last 10 years. During this period, equity investors achieved a positive return of 4.9%. We saw a loss in 2015 and 2022, but with a positive return between May and October eight times out of ten, the dictum "Sell in May" doesn't seem to hold true.

Table 2: Returns for May – October in the past 10 years

Source: Carson Research

Is this true?

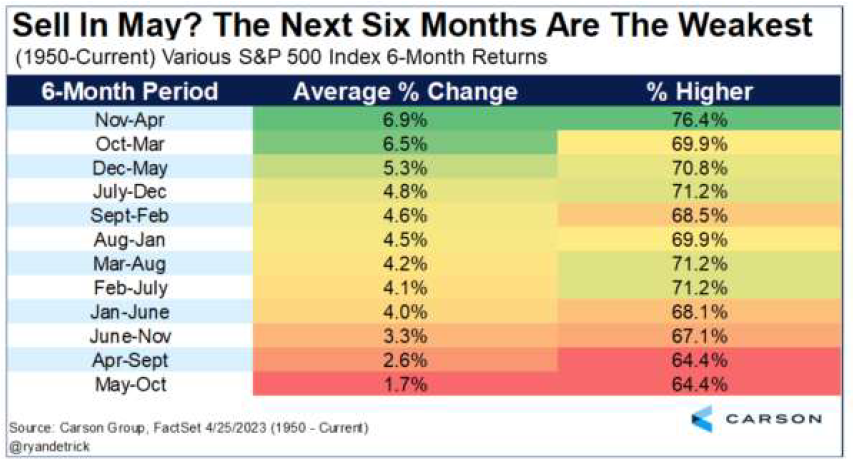

Table 3 effectively shows that the period between May and October has been by far the least profitable since the 1950s. Here is the likely origin of this "stock market truism". The table shows that the winter months have significantly outperformed the summer months. With an average return of 6.5% to 7% and a likelihood of a profit in 70% of the measured years, investing in the S&P 500 has proved to be an excellent idea since 1950.

But what about the summer? Was investing really off the table?

The answer to this is also clear: there was some interest, albeit much less, with the period from May to October yielding an average of 1.7%. However, this is still positive. Of all the years included in this calculation, more than 60% saw a gain.

In other words, selling off everything all at once can have an impact on your long-term returns. Instead of selling, investors could focus on lower risk shares in more defensive sectors, such as utilities or food and beverage companies, during the summer period.

Table 3: S&P 500 seasonal returns

Source: Carson Research

“Sell in May and go away” is, as you saw, a “stock exchange truism” that is anything but watertight. Since the 1950s, slavishly following this rule of thumb would have lost you an average yield of 1.7%. And there's no need, in our opinion.