Coronavirus blog Geert Van Herck: Property once again fails to deliver diversification bonus

Geert Van Herck

Chief Strategist KEYPRIVATE

May 25, 2020

(updated January 24, 2022)

4 minutes to read

Today, we will take a look at how the European property sector is performing on the stock markets. An opinion you will frequently hear is that property offers some good diversification options in periods of uncertainty or difficulty on the stock markets. It is regarded as a physical asset that delivers predictable income – monthly rents. But is that really the case?

Sadly, no. This is another "stock market truism" that you can figuratively throw out the window. The graph below shows us that the index for the European property sector underwent a serious correction in February and March – with serious meaning 30% to 40%. What has since followed over the last few weeks has been more of a weak sideways recovery.

In a nutshell, those investors who had diversified a part of their portfolio into property were (and still are) worse off for their efforts. You will find the same pattern if you look back at the 2007-2009 financial crisis.

Graph 1: STOXX Europe 600 Real Estate index

Source: Bigcharts

How can we explain this negative performance?

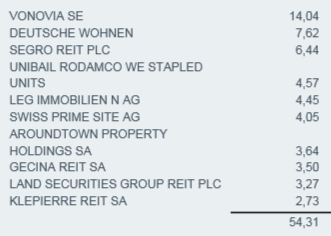

To be able to answer this, it is best to look at the most important shares in this index. Around two-thirds of the index is made up of mainly German, British and French companies, most of whom operate in the area of office and storage space rentals.

The coronavirus outbreak brought their business activities to a grinding halt. Industrial companies stopped production, shops closed and we saw some press reports of retail chains that did not want to pay their rents for several months. That sent a shockwave through the property sector, because many companies in this sector draw their revenues from shopping centres or warehouse rentals.

Even those leasing office buildings were not spared the pain. The coronavirus crisis now seems to be showing us that teleworking is not really an insurmountable problem for many businesses, which could lead to large companies leasing significantly less office space in the future. As you know, investors mainly try to predict the future. And the possibility that one version might be a much more "slimline" property sector explains why investors have sold up and got out of this sector in their droves.

Table 1: Main positions of the STOXX Europe 600 Real Estate index

Source: STOXX Europe

Our conclusion

Once again, exchange-listed property failed to deliver a diversification bonus during the most recent stock market correction. The main reason for this is that investors are no longer sure what will happen next, and actually fear that the sector will find it extremely difficult to maintain traditional cash flows at the same level in future.