Wealth report 2025: interview with the researchers

Keytrade Bank

keytradebank.be

May 15, 2025

(updated May 22, 2025)

4 minutes to read

The Belgian Wealth Report plots the wealth of Belgian households. What should we remember about the prosperity of families in our country? Researchers Margaux Bearelle (PhD student, Department of Economics, Ghent University) and Koen Inghelbrecht (Professor of Finance, Department of Economics, Ghent University) zoom in on the most striking results from the wealth survey.

What key lessons do you draw from the Belgian Wealth Report?

“Median household wealth in Belgium grew by 11.2% in 2025, to €277,231. Growth far exceeded inflation, with most households seeing their purchasing power and wealth increase. However, wealth accumulation is unevenly distributed. Households with more wealth achieved higher profits in absolute terms, further reinforcing existing disparities.”

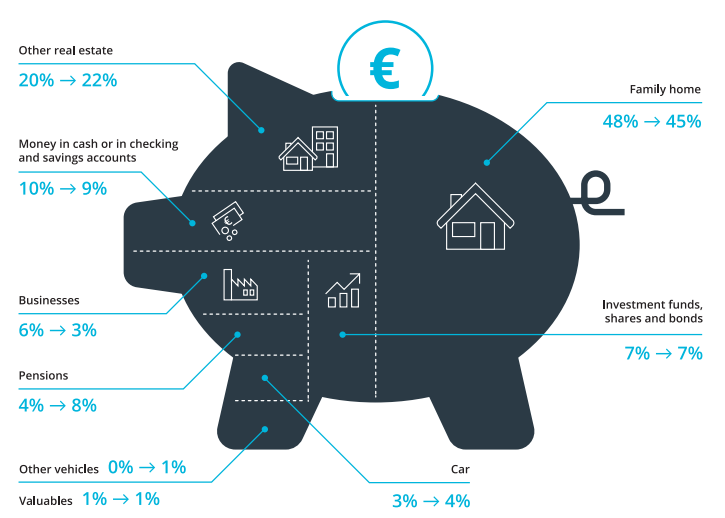

For Belgians, “Our home is our castle” is a cliché, but as with most clichés, there is an element of truth to it. Residential property accounts by far for the largest share of Belgian households’ wealth. Amongst younger households, property appears to be even more important, both family homes and other properties. They also mainly save for home ownership, and carry higher mortgage debt than older households. Amongst older households, the share of financial assets in wealth is growing.”

“Most Belgian households got richer, but wealth inequality also increased”

If you compare it with the 2024 wealth report, what trends and developments stand out?

“Belgian households adjusted their financial strategies in response to changing economic conditions. For property and other tangible assets, we see a slight decline in first-time home ownership. Apartments and land, in turn, are on the rise; the median value of apartments also increased the most. The number of loans for the purchase of secondary homes also increased.”

“For financial assets, the shifts in investment behaviour are more pronounced. Fixed term accounts in particular are on the rise. Banks have made their fixed term accounts more attractive by offering higher interest rates, in an attempt to attract the capital released from government bonds. In turn, bond holdings fell sharply. This is because the money Belgians invested into government bonds in 2024 then went into other financial products.”

Source : Wealth report 2025

Where did the billions from the government bonds go?

“One in five Belgians participated in the 2023 government bonds issue. This was huge, courtesy of the high interest rate, tax advantages and short maturity. When the government bonds expired after one year, only 31% of participants reinvested in similar bonds. Most households switched to savings accounts (46%) and fixed term accounts (33%). A much smaller percentage went towards riskier investments such as shares (6%) or property (3%).”

“The popularity of government bonds and the investment choice after the bond matures illustrate the risk aversion of many Belgian households. 93% of families prefer low-risk and medium-risk investments.”

Have cryptocurrencies actually made a breakthrough?

“Investments in cryptocurrencies are still quite a niche segment. 7% of households invest in crypto, up from 6% last year. This indicates a cautious adoption of digital assets, but interest still remains relatively limited. It is also predominantly concentrated among younger age groups.”

Click here to read the full report.