Inflation? Grab some commodities for your portfolio!

Keytrade Bank

keytradebank.be

July 27, 2021

(updated August 07, 2022)

4 minutes to read

Recent economic indicators point to strong growth in the global economy. One of the indicators we monitor most closely is the trend in global manufacturing confidence. Manufacturing confidence is at one of its highest levels in the last ten years. This is good news for global economic growth: when business leaders are feeling very optimistic, they invest in new machines and create new jobs.

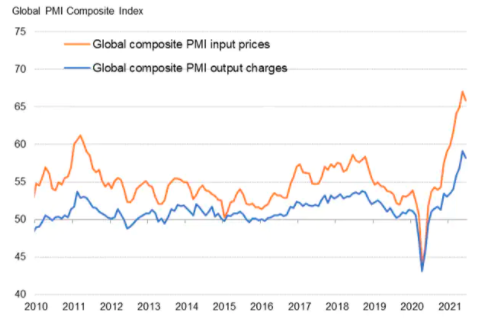

However, the blooming health of the global economy also has a downside: an increase in inflation as commodity prices surge. After all, when the global economy is running at top speed, demand for commodities such as oil, copper and steel also rises sharply. Since companies are facing higher purchase costs and want to maintain their profit margins, they pass on the higher commodity prices to their customers.

We can see this trend very clearly in Figure 1: the orange curve shows the change in purchase costs whereas the blue one shows the sales prices.

Figure 1: Trend in company purchase costs and sales prices

Source: IHS Markit, JPMorgan

The higher inflation figures also affect the financial markets too. You can find endless articles about the impact of inflation on your investment portfolio. The first lesson we want to teach investors is that equities are by far the best hedge against inflation. Normal inflation levels of 3%-5% do not pose any threat to equities. Higher inflation figures, however, will do so, because central banks will raise short-term interest rates sharply in order to bring inflation under control. A tighter monetary policy increases the fear of recession, which in turn makes investors unhappy because it means lower corporate earnings.

Other interesting alternatives to hedge a diversified investment portfolio against inflation include the following:

- Inflation-linked bonds: These bonds link the repayment of the invested capital to a consumer price index. If inflation rises, the amount you will receive on maturity will also rise. In some cases, the coupon is also calculated based on the indexed principal.

- Gold: This is probably the best-known asset class for protection against inflation. Note that this year, we are seeing a rise in inflation in the major economic regions. However, so far the trend in the price of gold has been rather disappointing, hovering around zero compared to the start of the year.

- • Commodities: Invest part of your portfolio in the actual source of the rise in inflation. At present, that is certainly the commodity markets. Commodities have had a turbulent decade (see Figure 2), but have risen strongly over the past year. A positive sign was breaking through the peak prices of 2015 and 2016. This illustrates that we have broken the pattern of ever-descending peaks. There are now commodity index trackers that you can use to buy into the rising trend. We would invest 10%-15% in commodities.

Figure 2: CRB Commodity Index

Bron: All Star Charts

- • Commodity producers: International mining companies and oil producers of course benefit from higher commodity prices, as they add to their profits. Investors can choose an actively managed fund that invests in large commodity companies, or opt for a tracker that follows the largest companies in the sector.

Conclusion

A strong global economy is fueling inflation. This does not have to become a problem for investors. Anyone looking to protect a diversified investment portfolio against higher inflation can focus on commodity index trackers or funds that invest in major companies in the commodities sector.

Geert Van Herck Chief Strategist KEYPRIVATE