How much additional income are you allowed to earn as a pensioner?

Keytrade Bank

keytradebank.be

July 29, 2022

(updated August 29, 2022)

5 minutes to read

One day you will find your job for life. And then you're on your way. However, you might have to wait a long time for that day. For some people, it only happens once they have already retired. Still, this does not have to pose a problem for these late bloomers – or indeed any other pensioner. Are you retired or maybe married to someone who receives a family pension? If so, you can still earn some extra cash.

How much extra can you earn?

You can earn unlimited additional income in a professional capacity during your retirement – whether in Belgium or abroad:

- from 1st January of the year in which you turn 65, if you receive your own retirement pension (possibly together with a survivor’s pension);

- if you have already worked 45 years when you start your pension or if you are receiving a transitional payment (i.e. a temporary payment to a surviving spouse who has not yet reached the age threshold to receive a survivor’s pension).

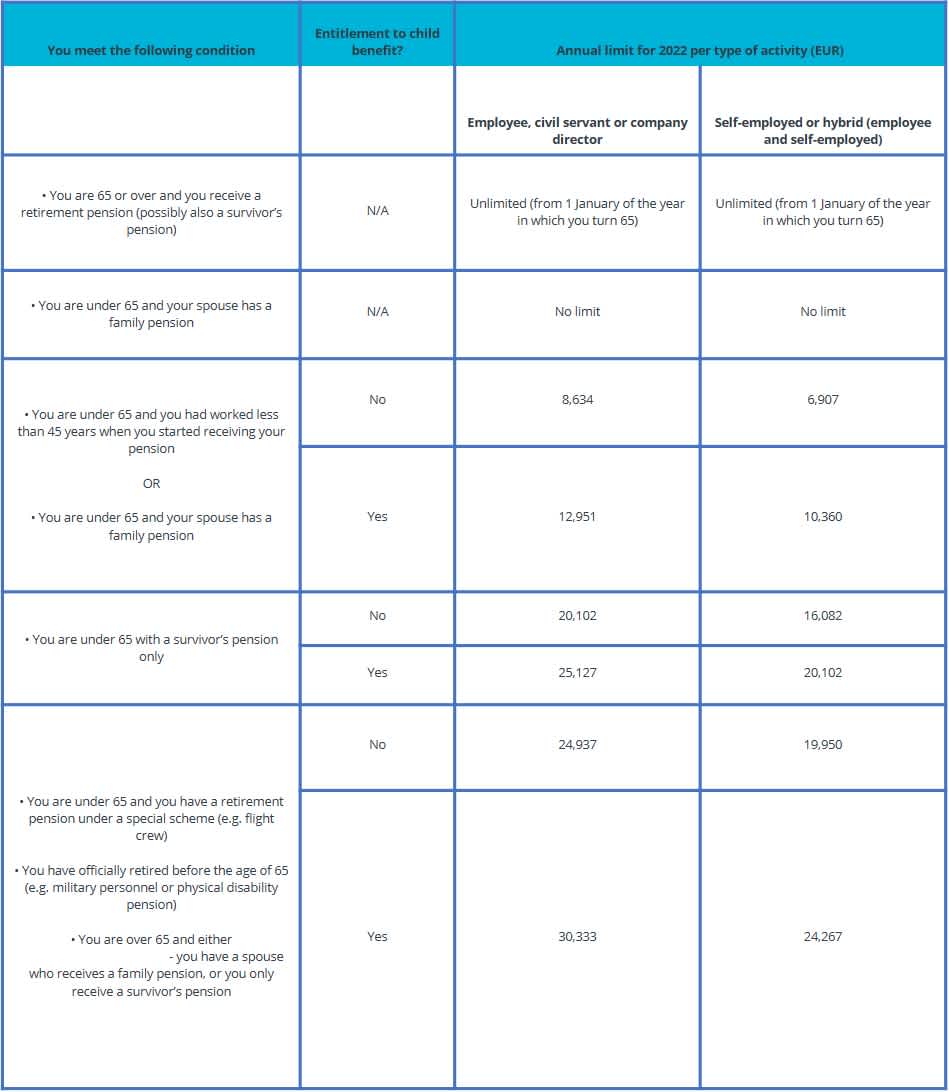

If you do not meet one of these conditions, you may still earn an additional income, but it may not be unlimited. The amount of additional income you – and your spouse if you receive a family pension – may earn depends, among other things, on the system under which you are paid your pension (self-employed, civil servant and/or employee), whether or not you receive child benefit, and the number of years you worked before receiving your pension. In this overview you will find the maximum amounts (source: Federal Pensions Service).

If you do not meet one of the three basic conditions, the maximum amount varies from EUR 8,634 to EUR 30,333 gross per year for employees and civil servants, and from EUR 6,907 to EUR 24,267 net for self-employed persons. If you earn extra during your retirement working as an employee or civil servant, your gross professional income will therefore be included. If you earn as a self-employed person, the net professional income is included.

Please note there are exceptions to these amounts. If, for example, you have additional earnings from writing scientific literature during your retirement, then the income is not capped. Before you start working, it is best to walk through your plans and your family situation with the Pension Service. You can call a pension service expert free of charge on 1765 (+32 78 15 17 65 from abroad) or submit your question online.

What if you earn more than is allowed?

If you earn more than the limit that applies, you risk having to repay part or even all of your statutory pension for the year in which you exceeded the ceiling. If you exceed the maximum amount by less than 100%, your pension will be reduced by an equal percentage. In other words, if you earn 10% more than permitted, you will have to repay 10% of your pension for the year in question. What if you exceed the limit by 100% or more? If so, you will have to repay your pension in full for that year.

If you receive a family pension, your spouse may not exceed the ceiling either. If they do, the family pension will be switched to a single person's pension; as a rule, the difference between the two will have to be reimbursed for the year in which the overrun occurred.

Do you accrue extra pension rights if you earn extra during your retirement?

In principle, you do not accrue additional pension rights, but there are a few exceptions. Did you work partly as an employee and partly as a self-employed person, and have you already retired as a self-employed person? If so, you can continue to accrue pension rights as an employee.

Did you work partly as an employee and partly as a self-employed person, and now are continuing to work as a self-employed person, but you claim your other pension (employee, civil servant or foreign pension)? If so, you will not accrue any further pension rights as a self-employed person. There are, however, some exceptional cases (e.g. for retired military) in which you can still build up pension rights as a self-employed person, even if you are already receiving your pension as an employee or civil servant.

Wondering whether you are eligible? You can ask a pension service expert for information free of charge on 1765 (+32 78 15 17 65 from abroad) or submit your question online.

How much will you have left after tax?

Any additional income you earn is taxed as earned income using progressive rates, either as a salary (for employees and civil servants) or as profits or benefits (for self-employed persons). The more you earn, the higher the tax burden.

Additional earnings can have a double tax hit: on the one hand, income from your activities is taxed, while on the other your pension may be taxed more heavily. To ease the tax burden, the government has been offering a complex reduction in tax on pension income for several years now. As a result, the likelihood of seeing most of your income go to the tax authorities is much lower (than before). If you want to avoid any nasty surprises, it is best to ask for a simulation beforehand.

Would you like to earn extra in a "normal" job or would you prefer to have a flexi-job?

In the case of a flexi-job, the gross salary and net salary are the same. As a pensioner, you therefore do not pay any social security contributions or taxes. If you are aged 65 or over, you can also earn unlimited extra money in a flexi-job. That is the good news, because pensioners who are only allowed to earn a little extra (see table above) will find that the income from their flexi-job is still counted as earned income. What’s more, flexi-jobs only exist in the hospitality industry, retail (bakery, clothing shop, etc.), supermarkets, hairdressing shops, beauty salons and fitness centres.